Market Overview:

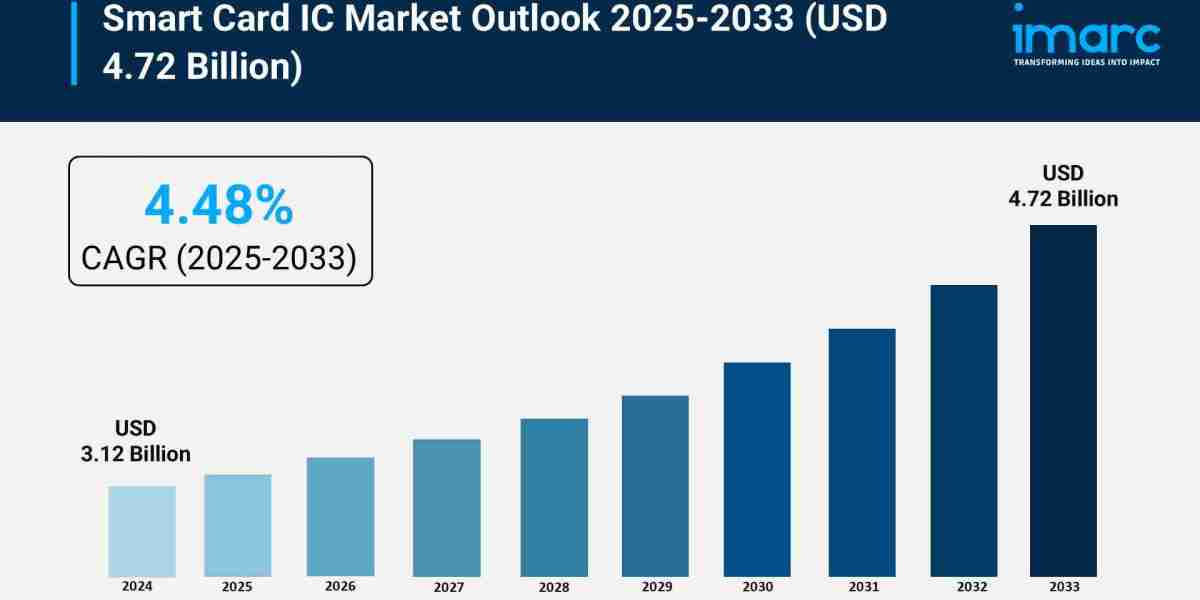

The smart card IC market is experiencing rapid growth, driven by rising demand for secure contactless payments, government-led digital identity programs, and proliferation of uSIMs and eSIMs in the telecom sector. According to IMARC Group's latest research publication, "Smart Card IC Market Size, Share, Trends and Forecast by Type, Interface, Architecture Type, Application, End Use Industry, and Region, 2025-2033", the global smart card IC market size was valued at USD 3.12 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 4.72 Billion by 2033, exhibiting a CAGR of 4.48% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/smart-card-ic-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Smart Card IC Market

- Rising Demand for Secure Contactless Payments

The global shift towards fast, secure, and tap-and-go transaction methods is the primary catalyst for the smart card IC market. This is evident in the finance sector, where a significant volume of ICs is being deployed annually. For instance, the financial sector alone is anticipated to account for over 50 million units of smart card ICs in the current year due to the continuous need to upgrade existing credit and debit card fleets. The convenience and enhanced security features of EMV (Europay, MasterCard, and Visa) contactless cards, which rely on dual-interface ICs, are accelerating this replacement cycle. Major card networks are actively incentivizing banks and merchants to adopt the necessary infrastructure. This widespread adoption of touch-free commerce in retail, hospitality, and public services is a major driver of demand for secure, high-performance microcontroller-based ICs.

- Government-Led Digital Identity Programs

Government initiatives worldwide to implement secure electronic identification (eID) and e-governance solutions are generating massive demand for smart card ICs. These multi-year national programs, which include e-passports, driver's licenses, and national ID cards, require ICs with advanced cryptographic features for data protection and citizen authentication. For example, countries with large populations, particularly in the Asia Pacific region, are leading the deployment of these large-scale identification systems. The need to combat identity theft and streamline public services has led to a requirement for ultra-secure microcontroller ICs. The government segment, especially in emerging economies, is therefore poised for substantial growth in adoption volume as these large-scale rollouts continue.

- Proliferation of USIMs and eSIMs in the Telecom Sector

The telecommunications industry remains a powerhouse for smart card IC consumption, driven by the sheer volume of Subscriber Identity Modules (USIMs) required for mobile devices. The segment currently holds the largest market share, accounting for over one-third of the total smart card IC market revenue. This high volume is sustained by the increasing global penetration of smartphones and the expansion of high-speed internet connectivity, which necessitate secure authentication elements. Furthermore, the market is undergoing a structural shift towards embedded SIMs (eSIMs), which are secure ICs integrated directly into devices like smartphones, wearables, and IoT equipment. This trend ensures continuous, high-volume demand as device manufacturers adopt eSIMs to support secure mobile communication and remote provisioning for connected ecosystems.

Key Trends in the Smart Card IC Market

- Biometric Authentication Integration

A key emerging trend is the integration of biometric sensors, typically for fingerprint recognition, directly onto the smart card itself. This creates a highly secure, personalized verification method that eliminates the need for a PIN at the point of sale. For instance, companies like Thales and IDEMIA are developing and rolling out biometric payment card solutions that store the user's encrypted fingerprint template on the chip. This not only enhances transaction security but also improves user convenience and reduces transaction errors, leading to authentication times that can be up to 20% faster than traditional PIN-based systems. This on-card matching capability ensures the user's biometric data never leaves the card, addressing privacy concerns and making it ideal for both high-security government IDs and premium financial products.

- Dual-Interface Adoption as a Standard

The move towards dual-interface ICs, which combine both contact (inserting the card) and contactless (tapping the card) functionality on a single chip, is rapidly becoming the industry standard. This trend is driven by the need for versatility and backward compatibility, allowing a single card to be used across diverse legacy and modern terminal infrastructure. For example, in regions like Asia-Pacific and Europe, more than 65% of new card issuances are already leveraging dual-interface ICs. This widespread adoption is seen across financial institutions, which can issue one card for all transaction types, and in multi-application environments like public transit networks, where the single IC can manage both fare payment via a tap and secure online top-ups via a contact reader.

- Microcontroller ICs for Higher Performance

The market is observing a definitive trend towards higher-performance IC architectures, with a notable acceleration in the deployment of 32-bit microcontroller-based chips. These advanced ICs offer significantly greater processing power, memory, and support for complex cryptographic algorithms compared to older architectures. This power is essential for enabling multi-application cards that can securely house a national ID, health record, and payment credentials simultaneously. For example, the segment for 32-bit ICs is expanding the fastest among all chip technologies. Their robust capabilities are vital for applications demanding the highest level of security, such as new generations of e-passports and the most sophisticated digital banking solutions, positioning them as the future backbone of secure credentialing.

Our report provides a deep dive into the smart card IC market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Leading Companies Operating in the Global Smart Card IC Industry:

- Analog Devices Inc

- CardLogix Corporation

- CEC Huada Electronic Design Co. Ltd.

- Eastcompeace Technology Co. Ltd.

- Imatric LLC

- On Semiconductor Corporation

- Shanghai Fudan Microelectronics Group Co. Ltd.

- SONY Group Corporation

- STMicroelectronics N.V.

- Texas Instruments Incorporated

- Toshiba Corporation

- Watchdata Technologies Pte Ltd.

Smart Card IC Market Report Segmentation:

By Type:

- Microcontroller

- Memory

Microcontroller exhibits a clear dominance in the market owing to its enhanced security features and versatility in various applications.

By Interface:

- Contact

- Contactless

- Dual Interface

Contactless represents the largest segment, as it offers greater convenience and faster transaction speeds, especially in transportation and payment systems.

By Architecture Type:

- 16-Bit

- 32-Bit

- Others

16-Bit leads the market with approximately 43.3% share in 2024 due to its balanced performance and cost efficiency, making it ideal for applications like payment cards and identity verification.

By Application:

- USIM/eSIMs

- ID Cards

- Employee ID

- Citizen ID

- E-Passport

- Driving License

- Financial Cards

- Credit Cards

- Debit Cards

- IoT Devices

USIM/eSIMs dominates the application segment, driven by the increasing demand for secure mobile communications and the adoption of eSIM technology, which enhances connectivity in the expanding IoT ecosystem.

By End Use Industry:

- E-Government

- Telecommunication

- Transportation

- Payment and Banking

- Others

Telecommunication holds around 40.0% market share in 2024, as the sector relies heavily on secure identity management and communication systems, particularly with the rollout of 5G technology and mobile payment solutions.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific dominates the market due to the high adoption of smart card technologies in financial services, telecommunications, and government sectors across the region.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302