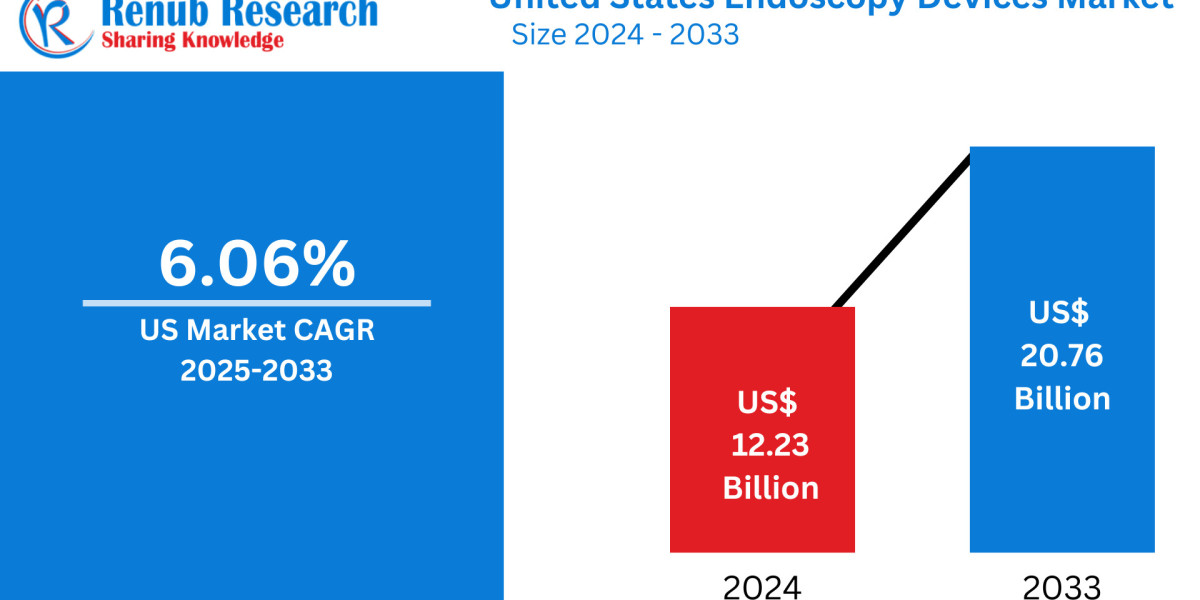

United States Endoscopy Devices Market – Trends and Summary (2025–2033)

The United States Endoscopy Devices Market is projected to reach US$ 20.76 billion by 2033, up from US$ 12.23 billion in 2024, expanding at a CAGR of 6.06% from 2025 to 2033. This robust growth is propelled by several key factors including the adoption of minimally invasive procedures, advances in imaging technologies, growing demand for outpatient care, and heightened emphasis on infection control using disposable endoscopes.

Market Overview

The prevalence of chronic conditions such as colorectal cancer, gastrointestinal disorders, and neurological issues is catalyzing demand for advanced diagnostic tools like endoscopes. Ongoing technological innovations—including high-definition (HD) imaging, AI-driven diagnostics, and 3D visualization—are enhancing procedural precision, accelerating diagnosis, and optimizing patient outcomes.

For instance, in January 2023, UC Davis Health launched an advanced endoscopy suite, signaling healthcare providers’ growing reliance on modern endoscopic tools. Furthermore, the aging U.S. population, more susceptible to chronic diseases, is amplifying the need for accurate and minimally invasive diagnostic technologies.

Additionally, the transition from inpatient care to Ambulatory Surgical Centers (ASCs) is reshaping healthcare delivery, making procedures faster and more cost-efficient. These shifts align with patient preferences for less invasive surgeries with quicker recovery times.

Key Growth Drivers

- Rising Prevalence of Obesity & Demand for Bariatric Endoscopy

The increasing obesity rate in the U.S. has heightened the use of endoscopic bariatric procedures, such as sleeve gastroplasty and intragastric balloon placement. These less invasive treatments offer safer alternatives to surgery, driving demand for endoscopic tools. With enhanced insurance coverage and patient awareness, bariatric endoscopy is becoming mainstream.

- Surge in Demand for Disposable Endoscopes

As infection control remains paramount, disposable endoscopes are seeing widespread adoption. Supported by regulatory agencies and improved cost-efficiency, these devices offer a practical alternative by minimizing cross-contamination risks and simplifying clinical workflows. A notable development includes the March 2024 collaboration between NTT Corporation and Olympus to launch a cloud-based endoscopic system with real-time image processing using AI and advanced networking technologies.

- AI-Enhanced Endoscopy Devices

The integration of Artificial Intelligence (AI) is redefining endoscopic diagnostics. In January 2024, the FDA approved ANX Robotica’s CapsuleX, an AI-powered capsule endoscope designed to enhance small bowel imaging. AI tools not only assist in early detection of gastrointestinal diseases but also attract investment and innovation in the endoscopy space.

Market Challenges

- Intense Market Competition & Saturation

Dominated by global giants like Olympus, Medtronic, and Stryker, the U.S. endoscopy market is highly competitive. Smaller players face significant barriers due to limited resources, R&D constraints, and regulatory hurdles, making it challenging to differentiate or scale their offerings.

- Burdensome Reprocessing and Maintenance

Reusable endoscopy devices require meticulous cleaning, sterilization, and reprocessing, demanding substantial investment in equipment, staff training, and regulatory compliance. Improper handling can lead to cross-infections or equipment failure, increasing the attractiveness of single-use alternatives—despite their higher long-term costs.

New Publish Reports

- United States Olive Oil Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- United States School Furniture Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- United States Biscuits Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

- United States Communication Equipment Market Size and Share Analysis - Growth Trends and Forecast Report 2025-2033

Segment Insights

- Product Type: Endoscopes Dominate

Endoscopes are the largest product category due to their widespread application across specialties including pulmonology, urology, and gastroenterology. Their ability to deliver high-resolution imaging and support therapeutic interventions makes them vital in modern healthcare.

- Application: Gastrointestinal Endoscopy Leads

Gastrointestinal (GI) endoscopy is the most frequently performed procedure in the U.S., used extensively for diagnosing ulcers, polyps, and digestive cancers. It enables real-time diagnosis and treatment, making it a core application in the endoscopic domain.

- Hygiene: Rise of Single-Use Devices

The single-use segment is expanding rapidly, especially in outpatient and ambulatory settings. These devices reduce the risk of hospital-acquired infections (HAIs), eliminate the need for sterilization, and improve procedural efficiency—making them attractive for healthcare providers.

- End-User: Hospitals Remain Primary Consumers

Hospitals account for the majority of endoscopic procedures due to their large patient base and comprehensive service offerings. The availability of advanced infrastructure and trained professionals also supports the dominance of hospitals in the endoscopic ecosystem.

State-Level Analysis

- California

A tech-forward state, California is a hub for endoscopy innovation and adoption. Its aging population, high concentration of hospitals and research institutions, and demand for outpatient care are driving sustained growth.

- Texas

Texas is a rapidly growing market driven by its expanding healthcare system and high prevalence of chronic conditions. Adoption of robotic and AI-enabled endoscopy tools is also accelerating across the state.

- New York

With its advanced medical infrastructure and emphasis on innovation, New York leads in procedural volume. The presence of leading academic hospitals boosts the adoption of next-gen endoscopy solutions.

- Florida

Florida's large senior population and increasing cases of GI, pulmonary, and urological disorders are fueling the demand for diagnostic and therapeutic endoscopic equipment. Technological advancements and strong healthcare networks make it a key growth state.

Market Segmentation Summary

Product Type (5 Segments)

- Endoscopes

- Visualization & Documentation Systems

- Mechanical Endoscopic Equipment

- Accessories

- Other Endoscopy Equipment

Application (9 Segments)

- Bronchoscopy

- Arthroscopy

- Laparoscopy

- Urology Endoscopy

- Neuroendoscopy

- Gastrointestinal Endoscopy

- Gynecology Endoscopy

- ENT Endoscopy

- Others

Hygiene (3 Segments)

- Single Use

- Reprocessing

- Sterilization

End-User (3 Segments)

- Hospitals

- Ambulatory Surgery Centers (ASCs)

- Others

States (29 Viewpoints)

Top markets include California, Texas, New York, Florida, Illinois, and more.

Leading Companies Covered (3 Viewpoints Each: Overview, Recent Developments, Revenue Analysis)

- Johnson & Johnson

- Stryker

- Boston Scientific

- CONMED

- Medtronic Plc

- Fujifilm Holdings

- Smith and Nephew

Key Takeaways

- Projected Market Size by 2033: US$ 20.76 Billion

- CAGR (2025–2033): 6.06%

- Top Growth Drivers: Technological innovation, minimally invasive trends, aging population, demand for outpatient procedures

- Notable Trends: AI integration, disposable endoscopes, 3D/HD imaging

- Primary End-Users: Hospitals and ASCs

- Dominant States: California, Texas, New York, Florida