In recent times, the concept of investing in gold by Particular person Retirement Accounts (IRAs) has gained important traction amongst buyers looking for to diversify their portfolios and safeguard their retirement savings. Gold IRA companies have emerged as key gamers in this area of interest market, providing people the opportunity to carry physical gold and different valuable metals inside their retirement accounts. This article explores the rise of gold IRA companies, their benefits, and the considerations buyers ought to keep in mind when choosing a provider.

Understanding Gold IRAs

A Gold IRA is a sort of self-directed particular person retirement account that enables investors to incorporate physical gold and different treasured metals as a part of their retirement portfolio. Unlike conventional IRAs, which typically hold stocks, bonds, and mutual funds, Gold IRAs present a hedge in opposition to inflation and financial instability. The intrinsic worth of gold typically increases throughout instances of economic uncertainty, making it a horny possibility for investors wanting to guard their wealth.

Gold IRA companies facilitate the process of organising and managing these accounts. If you liked this short article and you would like to receive a lot more info concerning https://empowerhunt.com/employer/buy-gold-ira kindly visit our own page. They assist shoppers in buying gold and other authorized treasured metals, guaranteeing that the investments adjust to IRS laws. These companies additionally provide storage solutions, as bodily gold should be kept in an accepted depository to maintain the tax-advantaged standing of the IRA.

The advantages of Investing in Gold IRAs

- Inflation Hedge: Certainly one of the first causes investors flock to gold is its historical capacity to retain value throughout inflationary periods. Not like fiat currencies, which can be devalued by authorities insurance policies, gold tends to understand over time, making it a reliable options for retirement iras store of value.

- Portfolio Diversification: Gold IRAs enable investors to diversify their retirement portfolios past conventional belongings. By including treasured metals, traders can scale back overall portfolio risk and enhance potential returns. Gold typically behaves in a different way than stocks and bonds, providing a buffer during market volatility.

- Tax Advantages: Gold IRAs supply the identical tax benefits as conventional IRAs. Contributions could also be tax-deductible, and the investments develop tax-deferred till retirement. Moreover, certified distributions are taxed at bizarre earnings charges, permitting traders to manage their tax liabilities strategically.

- Tangible Asset: Not like stocks or bonds, gold is a tangible asset that buyers can physically hold. This may provide peace of mind, as many people choose to have a portion of their wealth in a kind they can see and contact.

The Role of Gold IRA Companies

Gold IRA companies play a vital function in helping individuals navigate the complexities of investing in gold for retirement. These firms sometimes offer a range of services, together with:

- Account Setup: Gold IRA companies assist purchasers in establishing self-directed IRAs, ensuring compliance with IRS laws. They information buyers through the paperwork and help them perceive the foundations surrounding treasured metals investments.

- Investment Guidance: Many gold IRA companies make use of experts who can present invaluable insights into the gold market. They help shoppers choose the fitting sorts of gold and other treasured metals to incorporate of their IRAs, based mostly on individual investment objectives and market situations.

- Buying and Storage: Once an IRA is established, gold IRA companies facilitate the acquisition of permitted precious metals. In addition they arrange for safe storage in IRS-permitted depositories, making certain that the physical gold is protected and compliant with regulations.

- Ongoing Support: Reputable gold IRA companies provide steady help to their shoppers, holding them knowledgeable about market traits and aiding with any questions or considerations that will come up throughout the investment period.

Selecting the best Gold IRA Company

With a growing variety of gold IRA companies out there, selecting the appropriate provider is crucial for traders. Listed below are some key components to think about:

- Fame and Expertise: Search for corporations with a solid observe report and constructive buyer evaluations. Research their history, expertise within the trade, and any regulatory points they could have confronted.

- Fees and Prices: Totally different gold IRA companies have various charge buildings. Perceive the prices associated with establishing and sustaining the account, together with account setup fees, storage fees, and transaction charges. Transparency in pricing is crucial to keep away from unexpected expenses.

- Customer service: Glorious customer service is vital when coping with retirement investments. Choose a company that provides responsive assist and is prepared to answer questions and supply guidance throughout the funding course of.

- Funding Choices: Ensure that the gold IRA company provides a variety of funding options, including varied varieties of gold and different treasured metals. This flexibility permits investors to tailor their portfolios to their specific needs and preferences.

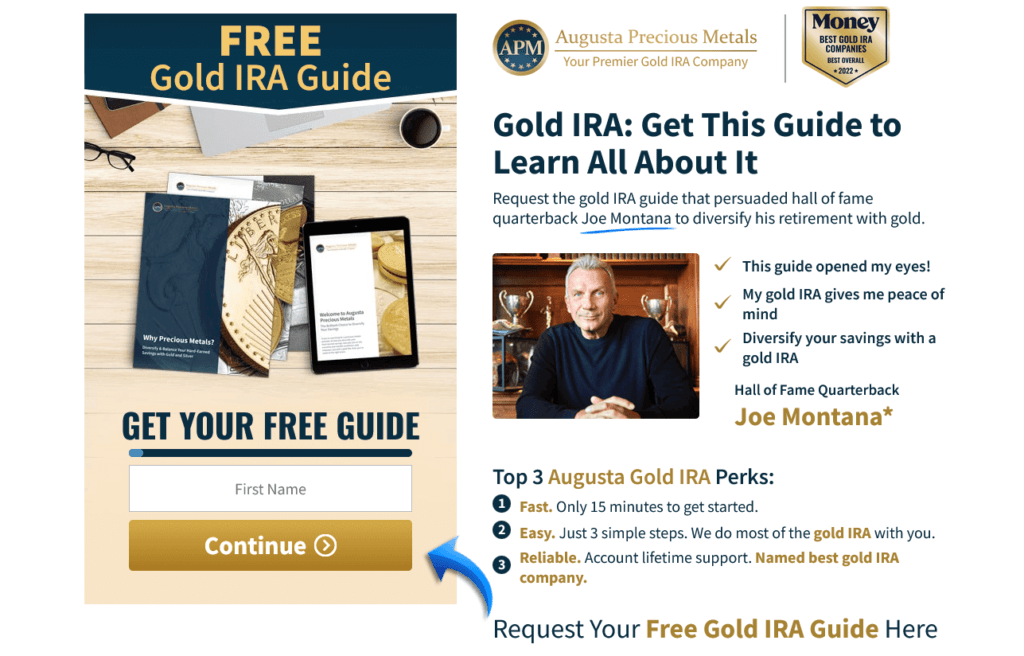

- Instructional Resources: A reputable gold IRA company should present educational resources to help purchasers perceive the intricacies of investing in precious metals. This may embody market analysis, investment guides, and webinars.

The future of Gold IRA Companies

As economic uncertainty continues to loom and inflation concerns rise, the demand for best gold ira companies for 2024 IRA companies is probably going to increase. Investors are becoming more conscious of the advantages of diversifying their portfolios with tangible belongings, and gold remains a popular alternative. Moreover, developments in expertise might further streamline the means of investing in trusted gold ira investment 2024 by IRAs, making it more accessible to a broader viewers.

In conclusion, gold IRA companies play a vital role in serving to investors secure ira companies for gold-backed retirement their financial futures by the inclusion of precious metals of their retirement accounts. By understanding the benefits of Gold IRAs and punctiliously deciding on a good supplier, individuals can take proactive steps to guard their wealth and ensure a stable retirement. As the landscape of retirement investing continues to evolve, gold IRAs are poised to stay a invaluable option for those seeking safety and diversification in their portfolios.