Market Overview:

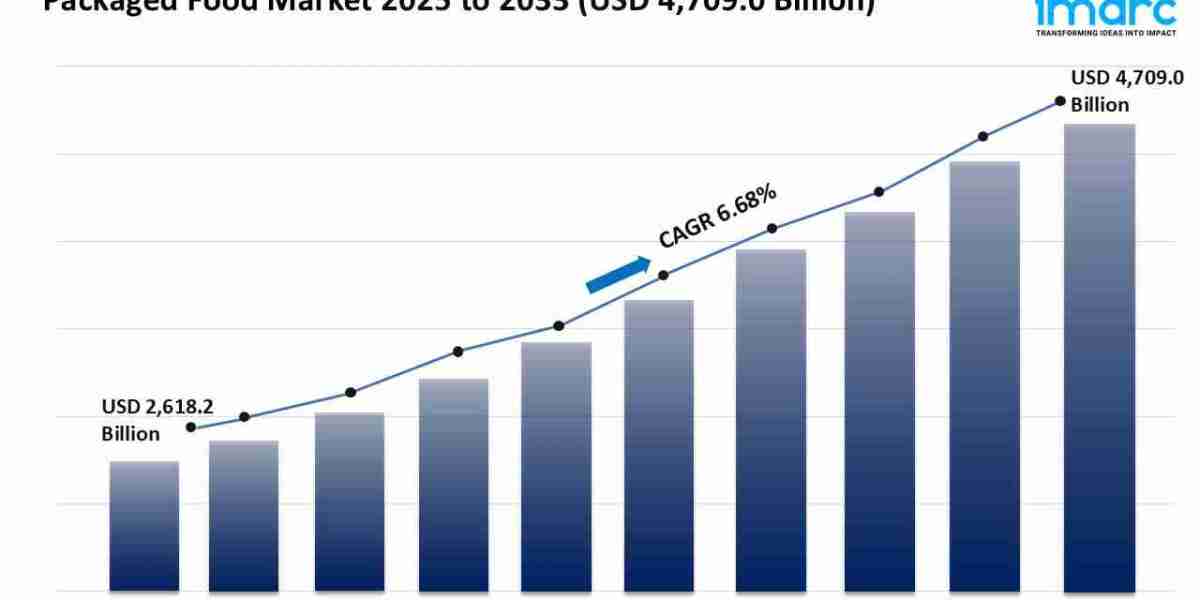

The packaged food market is experiencing rapid growth, driven by increasing demand for convenience and ready-to-eat solutions, evolving health and wellness trends, and expansion of e-commerce and digital retail. According to IMARC Group's latest research publication, "Packaged Food Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the global packaged food market size reached USD 2,618.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4,709.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.68% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/packaged-food-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Packaged Food Market

- Increasing Demand for Convenience and Ready-to-Eat Solutions

The accelerated pace of modern life, characterized by rising urbanization and a growing number of dual-income households globally, has cemented convenience as a primary driver for the packaged food industry. Consumers with time-compressed lifestyles actively seek out easy, ready-to-eat meals, frozen dinners, and meal kits that minimize preparation time. This demand fuels accelerated growth in segments like prepared foods. For instance, the meals segment is currently poised to become the fastest-growing category in the packaged food market, demonstrating the strong consumer propensity for convenience-driven food solutions. Companies are responding by launching new lines, such as General Mills expanding its portfolio with an organic frozen meal line under the Nature Valley brand, specifically targeting this need for convenient, healthier options.

- Evolving Health and Wellness Trends

A significant shift in consumer preferences towards healthier and cleaner food options is fundamentally reshaping the packaged food landscape. Consumers are increasingly scrutinizing labels, demanding products that are low-calorie, low-sugar, low-sodium, gluten-free, organic, or plant-based. This heightened health awareness is a critical growth factor, forcing major manufacturers to innovate and reformulate. For example, in a region like China, the government's "Healthy China 2030" initiative has directly accelerated the uptake of fortified, low-fat, and low-sugar foods, putting pressure on manufacturers to comply with policies and introduce healthier products. Furthermore, activities like Kraft Heinz's collaboration with a leading plant-based ingredient supplier to launch a new range of vegan condiments, including vegan mayo and ketchup, showcase the industry's strategic move to diversify and cater to the booming demand for plant-based alternatives.

- Expansion of E-commerce and Digital Retail

The rapid digitalization of commerce and significant improvements in delivery logistics are driving the packaged food industry's massive transition to online retail. The shift to e-commerce offers consumers unmatched convenience, variety, and personalized shopping experiences through digital platforms and direct-to-consumer models. Online channels are set to become the fastest-growing distribution segment in the market, benefiting from increasing internet penetration and smartphone usage worldwide. A concrete example of this dominance is observed in China, where e-commerce already accounts for over 30% of packaged food sales, largely dominated by platforms like Alibaba's Tmall and JD.com. This extensive reach and convenience mean that a growing percentage of the global market size, which was valued at $3.57 trillion in 2024, is moving to digital storefronts, necessitating major investments in faster and more reliable supply chain and delivery systems.

Key Trends in the Packaged Food Market

- Next-Generation Sustainable Packaging Solutions

There is a powerful emerging trend focused on drastically reducing the environmental impact of food packaging, particularly plastic waste. This shift is driven by both heightened consumer awareness and regulatory pressures, such as government bans on single-use, non-recyclable plastics. The trend involves a move towards compostable, biodegradable, paper-based, and mono-material solutions that adhere to "Designed For Recycling" principles. For instance, Mars China launched a Snickers bar using innovative mono-material flexible packaging made from mono PP, ensuring easier recycling in designated streams, while providing a low-sugar alternative. Furthermore, companies like Pakka, a producer of compostable options, introduced a new line of flexible compostable packaging products to meet the rising need for eco-friendly alternatives. The global food packaging market, which was valued at over $500 billion in 2024, is now seeing significant investment in these sustainable innovations to meet both consumer and environmental demands.

- Integration of Smart and Intelligent Packaging

The incorporation of technology like the Internet of Things (IoT), sensors, and digital identifiers into packaging is creating an era of 'smart packaging' that enhances food safety, quality, and consumer engagement. Intelligent packaging systems use real-time monitoring to provide data on a product's condition throughout the supply chain. For example, one innovative technology involves using IoT sensors combined with AI analytics to measure conditions inside the pack. This helps in quality control by detecting oxygen levels using patented food-safe ink, which allows for the real-time rejection of out-of-spec packages via inline scanning systems in supermarkets. This trend not only improves product quality assurance and minimizes spoilage but also supports the growing consumer demand for greater transparency, allowing shoppers to access nutritional data and sourcing information instantly via QR codes on the packaging.

- Functional and Personalized Nutrition

A major trend is the pivot toward packaged foods that offer specific, targeted health benefits beyond basic nutrition, falling under the umbrella of functional foods and personalized nutrition. Consumers are actively seeking products fortified with vitamins, prebiotics, probiotics, and other beneficial ingredients to support immunity, gut health, or other wellness goals. This has accelerated the demand for nutraceuticals and led to highly tailored product development. A concrete example is the focus on personalized meal shakes based on genetic profiles, such as the offerings from the British startup NGX, which develops meal shakes tailored to an individual’s DNA-based nutritional needs. Moreover, advancements in FoodTech, including precision fermentation, are enabling the creation of sustainable proteins and ingredients with improved taste and texture profiles for alternative dairy and meat products, meeting the growing market of consumers focused on bio-individual dietary habits.

Leading Companies Operating in the Packaged Food Industry:

- Aidells Sausage Company (Tyson Foods, Inc.)

- Conagra, Inc.

- Danone S.A

- General Mills Inc.

- Hormel Foods Corporation

- Kellanova

- Maple Leaf

- Nestlé S.A

- Smithfield Foods, Inc.

- Unilever

- WH Group Limited

Packaged Food Market Report Segmentation:

By Product Type:

- Bakery Products

- Dairy Products

- Beverages

- Breakfast Products

- Meals

- Others

Bakery Products hold the largest market share due to consumer popularity, versatility, and alignment with trends such as indulgence and nostalgia.

By Distribution Channel:

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Others

Supermarket/Hypermarket currently account for the largest market share, offering a convenient one-stop shopping experience with competitive pricing and extensive reach.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia-Pacific exhibits clear dominance in the market, leading in market share among all major regional markets.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302