Market Overview:

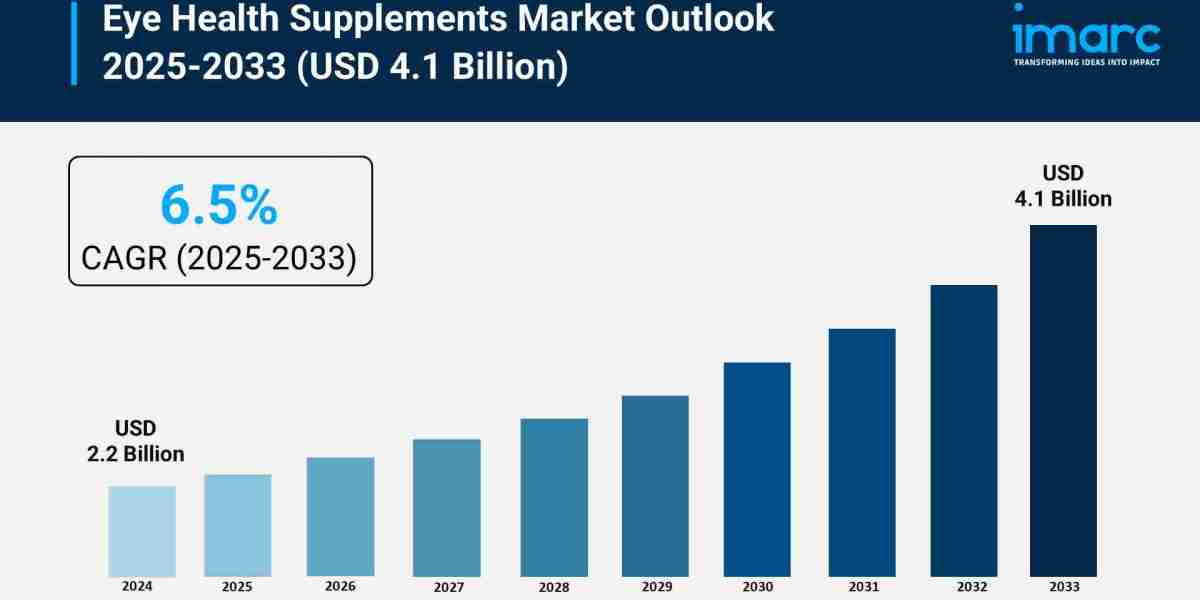

The eye health supplements market is experiencing rapid growth, driven by expanding geriatric population and ocular disease prevalence, surge in digital screen time and eye strain, and proactive consumer focus on preventive health. According to IMARC Group’s latest research publication, “Eye Health Supplements Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, The global eye health supplements market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.1 Billion by 2033, exhibiting a growth rate (CAGR) of 6.5% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/eye-health-supplements-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Eye Health Supplements Market

- Expanding Geriatric Population and Ocular Disease Prevalence

The increasing number of older adults worldwide is a primary catalyst for market expansion. As longevity increases, so does the prevalence of age-related eye conditions like Age-Related Macular Degeneration (AMD) and cataracts. For instance, global statistics indicate that approximately 2.2 billion people currently have vision impairment or blindness, with AMD being a leading cause. The segment of the market dedicated to AMD management, which relies heavily on supplements containing specific nutrients like lutein and zeaxanthin, is significant. In a recent period, the AMD indication segment accounted for a revenue share that neared 41% of the eye health supplements market. This demographic reality creates a sustained, non-cyclical demand for preventative and supportive nutritional products endorsed by ophthalmologists and other eye care professionals.

- Surge in Digital Screen Time and Eye Strain

The widespread adoption of digital devices, including smartphones, computers, and tablets, has led to a dramatic rise in digital eye strain and associated vision issues, fueling supplement demand from younger demographics. This constant exposure to high-energy blue light is driving consumers, particularly millennials and younger adults, to seek protective and symptom-alleviating products. A recent industry report noted a substantial pivot toward digital channels, with online supplement sales on leading marketplaces surging by 77% over a three-year period, reflecting a broader consumer trend toward research-driven self-care and a proactive approach to managing the effects of digital life. Supplements containing Astaxanthin and specific carotenoids are marketed specifically for blue light protection and reducing eye fatigue.

- Proactive Consumer Focus on Preventive Health

A foundational shift in consumer mindset toward preventive healthcare is boosting the supplement market beyond curative measures. Consumers are increasingly knowledgeable about the link between nutrition and long-term eye health, driven by educational campaigns and a wealth of online information. This heightened health consciousness is reflected in purchasing decisions. For example, the segment comprising Lutein and Zeaxanthin supplements—two ingredients with strong clinical backing for macular pigment enhancement—is projected to dominate, capturing approximately a 46.3% market share. This demand supports ongoing product innovation, such as Alcon's recent regulatory approval for a novel combination eye supplement formulated to address both AMD and cataracts, further embedding supplements in the preventive health dialogue.

Key Trends in the Eye Health Supplements Market

- Shift Towards Personalized Ocular Nutrition

A major emerging trend is the move away from one-size-fits-all products toward highly personalized ocular nutrition strategies. This shift is enabled by advancements in digital health and diagnostics, where consumers can assess their individual risks or needs. For instance, the integration of AI-driven dietary assessments and remote telehealth consultations is now allowing brands to craft targeted outreach and personalized product recommendations. Companies are developing formulations designed for niche needs, such as supplements for specific stages of Age-Related Macular Degeneration (early vs. late stage) or products designed purely for mitigating digital eye strain related to prolonged screen exposure, moving beyond general vision support into highly specific, evidence-backed regimen adherence.

- Advanced Bioavailability and Novel Delivery Forms

Innovation in supplement form and formulation is focusing heavily on enhancing the bioavailability of key ingredients, ensuring nutrients are better absorbed by the body for maximum efficacy. A cutting-edge example of this is the application of nanotechnology, which involves shrinking nutrient particles to a size of 1-100 nanometers to facilitate easier penetration of cell membranes, leading to enhanced absorption. This technology is being leveraged by brands like Wellbeing Nutrition, which introduced an all-natural eye vitamin utilizing nanotechnology in the form of fast-dissolving oral strips. Furthermore, there is growing consumer demand for convenient, non-traditional delivery systems beyond tablets, such as plant-based softgels, gummies, and liquid drops, reflecting an industry effort to improve consumer compliance and appeal to a broader audience.

- The Rise of Sustainable and Vegan Ingredient Sourcing

The increasing consumer demand for natural, sustainable, and plant-based products is profoundly influencing the sourcing of critical eye health ingredients, notably Omega-3 fatty acids. Traditionally sourced from fish oil, the market is now seeing a significant rise in algae-based Omega-3s, which provide DHA and EPA while appealing to vegan and vegetarian consumers and addressing concerns about marine overfishing and heavy metal contamination. This is coupled with a push for overall ingredient transparency, where companies are using technology like blockchain tracing to verify the sustainability and purity of their raw materials. This trend aligns premium products with ethical and environmental values, differentiating challenger brands and leading to the introduction of plant-based supplement lines, such as Nature's Way's new organic, plant-based eye supplements.

Leading Companies Operating in the Global Eye Health Supplements Industry:

- Alliance Pharma PLC

- Amway International (Alticor)

- Bausch & Lomb Incorporated

- Eyescience Labs

- Kemin Industries Inc.

- Novartis AG

- NutraChamps

- Nutrivein

- Pfizer Inc.

- The Nature's Bounty Co.

- Vitabiotics Ltd.

- ZeaVision LLC

Eye Health Supplements Market Report Segmentation:

By Ingredient Type:

- Lutein and Zeaxanthin

- Antioxidants

- Omega-3 Fatty Acids

- Coenzyme Q10

- Flavonoids

- Alpha-Lipoic Acid

- Others

Lutein and zeaxanthin dominate the market due to their proven ability to protect the macula and improve visual function.

By Indication:

- Age-Related Macular Degeneration (AMD)

- Cataract

- Dry Eye Syndrome

- Inflammation

- Others

Age-related macular degeneration holds the largest share due to its prevalence among aging populations worldwide.

By Formulation:

- Tablets

- Capsules

- Powder

- Others

Tablets dominate the market due to convenience, longer shelf life, and higher ingredient concentration capabilities.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America enjoys the leading position owing to high health awareness and aging population demographics.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302