Market Overview

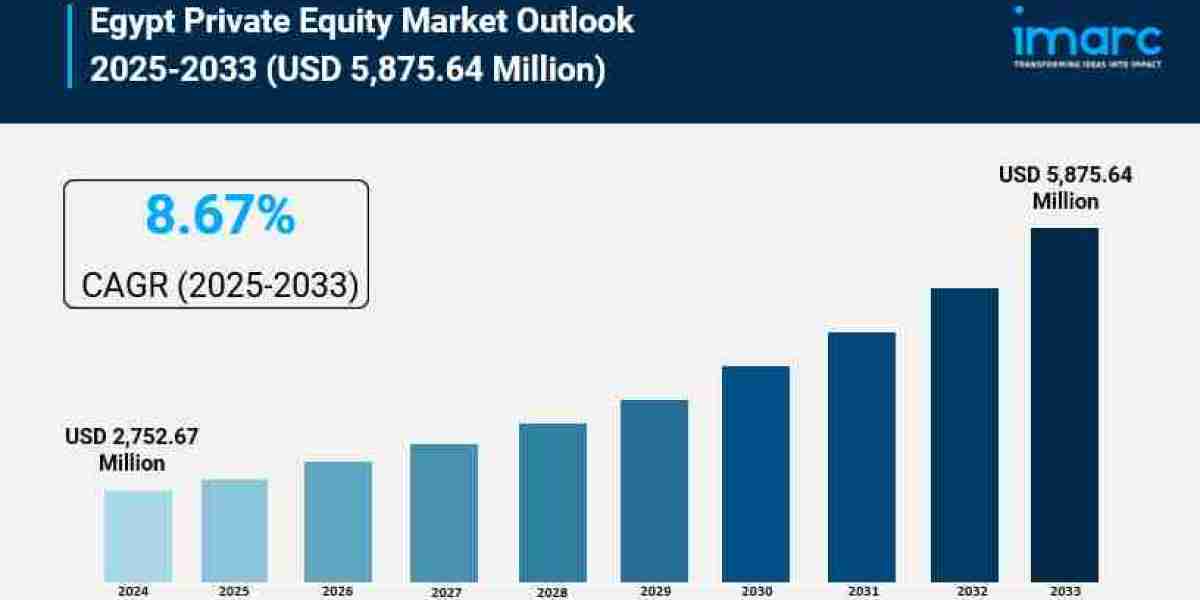

The Egypt private equity market size reached USD 2,752.67 Million in 2024 and is expected to grow to USD 5,875.64 Million by 2033. The market forecast period is 2025-2033, with a CAGR of 8.67%. This growth is driven by regulatory reforms, technology- and export-focused investment mandates, increased foreign direct investment, and a resurgence in mergers and acquisitions. Government incentives, digital transformation policies, and infrastructure projects are further boosting the private equity market share in Egypt.

How AI is Reshaping the Future of Egypt Private Equity Market

- AI-driven analytics enhance investment decision-making, improving accuracy and reducing risks in private equity transactions.

- Government-backed digital transformation initiatives foster AI integration in investment sectors, promoting innovative startups.

- AI facilitates efficient deal sourcing and due diligence, supporting the rise in deal activity, including tech and fintech segments.

- Precision agriculture technologies supported by AI attract private equity, exemplified by investments such as Morpho Investments’ backing of Agriventures.

- AI-powered platforms increase transparency and operational efficiency in portfolio management, aligning with regulatory clarity improvements.

- AI adoption stimulates growth in sectors like fintech, agriculture, and energy, increasing foreign direct investment interest and market diversification.

Grab a sample PDF of this report: https://www.imarcgroup.com/egypt-private-equity-market/requestsample

Market Growth Factors

A key growth factor for the Egypt private equity market is the regulatory reforms that have enhanced the investment landscape. In 2024, there was a significant surge in deal activity, with 77 transactions including prominent investments such as B Investments’ stake in Orascom Financial and a $157 Million fintech deal by MNT Halan. Regulatory advances like Golden Licenses, pre-merger notification reforms, and tax incentives targeted at technology, green energy, and manufacturing sectors have improved investor confidence and market predictability, stimulating increased foreign direct investment and deal-making.

Investments focusing on technology, consumer-facing, and export businesses are also fueling market expansion. Leading private equity firms like Ezdehar plan to deploy $50–100 Million across sectors including higher education, retail, IT services, and consumer goods. Their strategy of taking majority or influential minority stakes to drive operational growth is reinforced by broader macroeconomic reforms, privatization efforts, and foreign investor interest in tourism, fintech, and real estate, thereby diversifying sectoral exposure and bolstering market resilience.

Government incentives combined with infrastructure and digital transformation policies constitute another growth driver. These initiatives have created new investment opportunities and supported private equity market expansion by facilitating privatization and attracting foreign sovereign fund participation. Strategic government-backed projects enhance operational readiness and scalability for investments, thereby strengthening the overall private equity ecosystem in Egypt.

Market Segmentation

Fund Type Insights:

- Buyout

- Venture Capital (VCs)

- Real Estate

- Infrastructure

- Others

Regional Insights:

- Greater Cairo

- Alexandria

- Suez Canal

- Delta

- Others

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent Developement & News

- May 2025: Morpho Investments launched its inaugural $55 Million private equity fund and invested in Agriventures and Jinet Agriculture, focusing on precision farming and food security enhancement.

- May 2025: Bluewater sold Apex International Energy to United Energy Group Limited following rapid upstream oil and gas sector growth, with Apex becoming one of Egypt’s top ten producers.

- May 2025: The market witnessed increased deal activity and foreign investor interest driven by regulatory clarity, privatization initiatives, and government reforms improving the investment climate.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302