Saudi Arabia Non-Dairy Coffee Creamers Market Overview

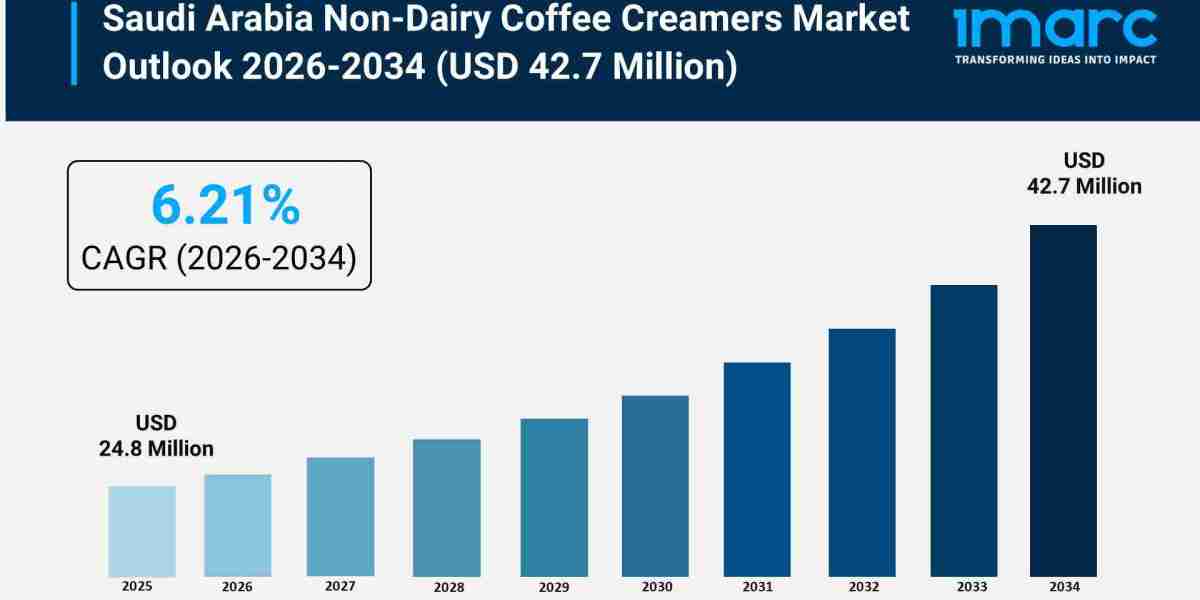

Market Size in 2025: USD 24.8 Million

Market Size in 2034: USD 42.7 Million

Market Growth Rate 2026-2034: 6.21%

According to IMARC Group's latest research publication, "Saudi Arabia Non-Dairy Coffee Creamers Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia non-dairy coffee creamers market size was valued at USD 24.8 Million in 2025. Looking forward, IMARC Group estimates the market to reach USD 42.7 Million by 2034, exhibiting a CAGR of 6.21% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Non-Dairy Coffee Creamers Market

- AI-driven consumer analytics identify flavor preferences and dietary trends in Saudi Arabia, enabling brands to develop personalized non-dairy creamer formulations targeting specific health-conscious demographics.

- Smart supply chain management powered by AI optimizes ingredient sourcing and distribution networks, reducing waste and ensuring fresher plant-based creamer products reach Saudi retail outlets efficiently.

- AI-enhanced quality control systems monitor production processes in real-time, detecting inconsistencies in texture and taste to maintain premium standards for almond, oat, and coconut-based creamers.

- Predictive demand forecasting uses AI algorithms to anticipate seasonal consumption patterns across Saudi regions, helping manufacturers adjust production volumes and minimize inventory costs effectively.

- AI-powered chatbots and recommendation engines on e-commerce platforms guide Saudi consumers toward suitable non-dairy creamer options based on dietary restrictions, flavor preferences, and health goals.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-non-dairy-coffee-creamers-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Non-Dairy Coffee Creamers Industry

Saudi Arabia's Vision 2030 is revolutionizing the non-dairy coffee creamers industry by prioritizing health consciousness, sustainability, and economic diversification amid evolving consumer preferences. The initiative drives demand for plant-based alternatives, integrating innovative formulations to address lactose intolerance and wellness trends across the Kingdom. This transformation aligns with food security and sustainable agriculture goals, promoting clean-label products and natural ingredients in retail spaces and cafes. Local manufacturing incentives spur innovation and reduce import dependence, while international brands introduce fortified, low-sugar options that cater to Saudi dietary preferences. Ultimately, Vision 2030 elevates the sector as a cornerstone of healthy lifestyle choices, enhancing consumer wellbeing and positioning Saudi Arabia as a leader in plant-based food innovation.

Saudi Arabia Non-Dairy Coffee Creamers Market Trends & Drivers:

Saudi Arabia's non-dairy coffee creamers market is experiencing robust growth, driven by rising health consciousness and increasing awareness about lactose intolerance, elevated cholesterol, and obesity across the population. The market is fueled by consumers actively searching for plant-based and low-fat substitutes for traditional dairy items, with the National Health Survey conducted by the General Authority for Statistics revealing that obesity has become a significant health concern in Saudi Arabia. Non-dairy creamers, typically derived from components like almond, soy, or oat milk, provide suitable options for those steering clear of dairy for health-related concerns, corresponding with a wider movement towards more nutritious eating habits and wellness-focused lifestyles across residential and commercial sectors.

The rapid expansion of convenience culture and e-commerce accessibility is significantly boosting market demand. With hectic lifestyles, consumers are increasingly opting for ready-to-use products that offer fast, easy solutions without sacrificing taste or quality, while non-dairy coffee creamers provide convenient enhancement eliminating the need for refrigeration or complex preparation. The International Trade Administration projects that the number of internet users participating in e-commerce in Saudi Arabia will continue growing, highlighting the increasing trend of online retail. The growth of online shopping enables buyers to effortlessly purchase their preferred items from the convenience of their homes, while the shift towards convenience remains a crucial factor strengthening market expansion across supermarkets, hypermarkets, and digital retail channels.

Saudi Arabia Non-Dairy Coffee Creamers Market Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Low Fat

- Medium Fat

- High Fat

Form Insights:

- Powder

- Liquid

Source Insights:

- Almond

- Coconut

- Soy

- Others

Flavor Insights:

- French Vanilla

- Caramel

- Hazelnut

- Irish Crème

- Others

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Channels

- Others

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Non-Dairy Coffee Creamers Market

- January 2025: The Saudi Food and Drug Authority introduced enhanced clean-label regulations requiring transparent ingredient disclosure on all non-dairy food products, driving manufacturers to reformulate coffee creamers with natural components and eliminate artificial additives, supporting consumer demand for healthier plant-based options aligned with wellness trends across the Kingdom.

- February 2025: Saudi retail chains expanded dedicated plant-based product sections in supermarkets and hypermarkets nationwide, partnering with international non-dairy brands to introduce premium almond, oat, and coconut creamer varieties targeting health-conscious consumers, reflecting the growing adoption of vegan and flexitarian lifestyles among urban populations in Riyadh, Jeddah, and Dammam.

- March 2025: Major food service operators and café chains across Saudi Arabia launched new plant-based beverage programs featuring non-dairy creamer options, responding to increasing customer requests for lactose-free alternatives, while implementing staff training initiatives to educate baristas on proper preparation techniques for specialty coffee drinks using alternative milk products and creamers.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302