In an era of economic uncertainty and fluctuating markets, many investors are seeking ways to safeguard their wealth and ensure a stable financial future. One of the most appealing options that has gained traction in recent years is investing in a Gold Individual Retirement Account (IRA). This investment vehicle not only offers the potential for growth but also serves as a hedge against inflation and market volatility. This article explores the ins and outs of Gold IRAs, their benefits, and how to get started.

Understanding Gold IRAs

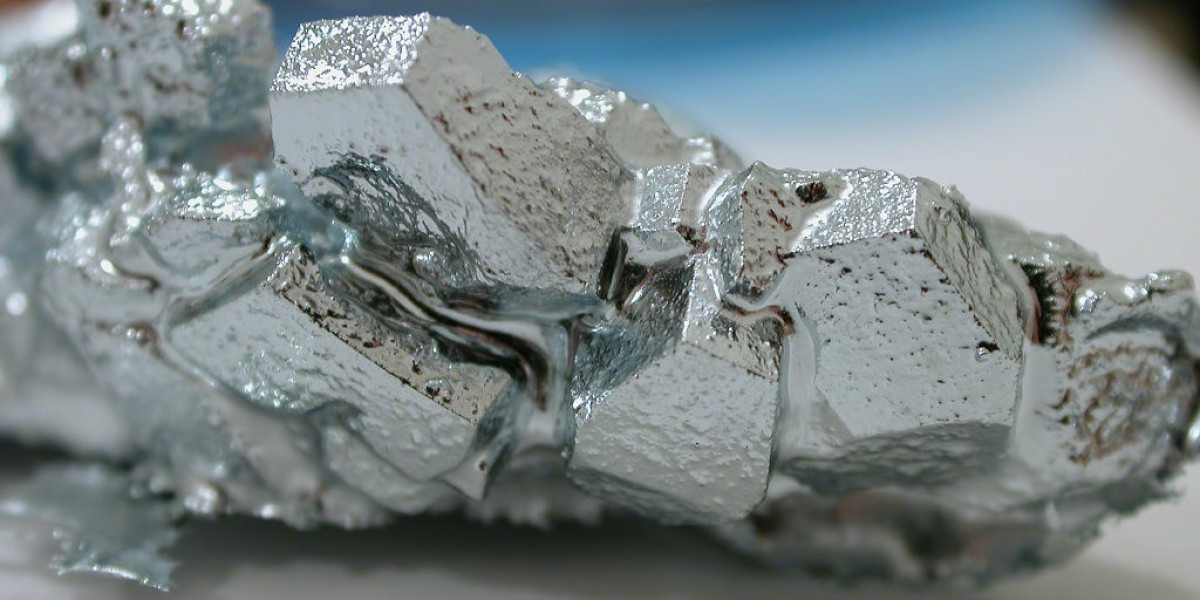

A Gold IRA is a self-directed retirement account that allows investors to hold physical gold, along with other precious metals, as part of their retirement portfolio. Unlike traditional IRAs that typically hold stocks, best gold ira fees bonds, and mutual funds, a Gold IRA gives individuals the opportunity to invest in tangible assets that have intrinsic value.

The Internal Revenue Service (IRS) regulates Gold IRAs, allowing specific types of gold and other precious metals to be held in these accounts. Eligible metals include gold bars and coins that meet a certain purity level, as well as silver, platinum, and Best gold ira fees palladium. This regulation ensures that investors are purchasing high-quality assets that can withstand the test of time.

The Benefits of Investing in Gold IRAs

- Hedge Against Inflation: Historically, gold has been viewed as a safe haven during inflationary periods. As the cost of living rises, the value of gold tends to increase, making it a reliable store of value. By investing in a Gold IRA, individuals can protect their retirement savings from the eroding effects of inflation.

- Portfolio Diversification: best gold ira fees Adding gold to an investment portfolio can enhance diversification. Since gold often moves independently of stocks and bonds, it can reduce overall portfolio risk. This diversification can be particularly beneficial during economic downturns when traditional investments may underperform.

- Tangible Asset: Unlike paper assets, gold is a physical commodity that investors can hold in their hands. This tangibility provides a psychological comfort that many investors appreciate, especially during times of market instability. Gold’s intrinsic value has been recognized for centuries, making it a trusted asset.

- Tax Advantages: Gold IRAs offer the same tax benefits as traditional IRAs. Contributions may be tax-deductible, and the investment grows tax-deferred until withdrawal. In case you have almost any inquiries with regards to where by along with the best way to employ plane3t.Soka.ac.jp, it is possible to contact us at our own web site. This tax-efficient structure allows investors to maximize their retirement savings.

- Wealth Preservation: Gold is often seen as a means of preserving wealth across generations. In times of economic crisis or best gold ira fees geopolitical instability, gold has historically maintained its value, making it an attractive option for those looking to protect their family’s financial legacy.

How to Get Started with a Gold IRA

Investing in a Gold IRA involves several key steps, each of which is crucial for ensuring a successful investment experience:

- Choose a Custodian: The first step in setting up a Gold IRA is to select a reputable custodian. Custodians are financial institutions that manage the account and ensure compliance with IRS regulations. It’s essential to choose a custodian that specializes in precious metals and has a solid track record.

- Open the Account: Once a custodian is selected, investors can open their Gold IRA account. This process typically involves filling out an application and providing necessary identification and financial information.

- Fund the Account: Investors can fund their Gold IRA through various methods, including rollovers from existing retirement accounts, direct contributions, or transfers from other IRAs. It’s important to adhere to IRS guidelines during this process to avoid tax penalties.

- Select Precious Metals: After funding the account, investors can choose the specific gold and other precious metals they wish to include in their portfolio. The custodian will provide a list of eligible products that meet IRS standards.

- Storage: Physical gold must be stored in an IRS-approved depository. Investors cannot keep their gold at home due to IRS regulations. Custodians typically work with secure storage facilities to ensure the safety of the metals.

- Monitor and Manage: Once the Gold IRA is established and Best gold ira Fees funded, investors should monitor their investments regularly. Keeping track of market trends and the performance of gold can help investors make informed decisions about when to buy or sell.

Potential Drawbacks to Consider

While there are many benefits to investing in a Gold IRA, it’s also important to consider potential drawbacks:

- Higher Fees: Gold IRAs often come with higher fees compared to traditional IRAs. These fees may include setup fees, storage fees, and transaction fees. Investors should carefully review the fee structure of their chosen custodian.

- Limited Liquidity: Selling physical gold can be less liquid than selling stocks or bonds. Investors may face challenges in quickly converting their gold into cash, especially during times of high demand.

- Market Fluctuations: While gold is generally considered a stable investment, its price can still fluctuate based on market conditions. Investors should be prepared for potential price volatility.

- Complexity: The process of setting up and managing a Gold IRA can be more complex than traditional retirement accounts. Investors may need to do additional research and seek professional advice to navigate the intricacies.

Conclusion

Investing in a Gold IRA can be a strategic move for those looking to diversify their retirement portfolios and protect their wealth from economic uncertainties. With its potential for growth, hedging capabilities, and tax advantages, a Gold IRA offers a unique opportunity for investors. However, it’s essential to weigh the benefits against the potential drawbacks and to approach this investment with careful consideration.

As the global economy continues to evolve, more individuals are recognizing the value of precious metals as a secure and reliable investment option. By taking the necessary steps to establish a Gold IRA, investors can position themselves for a more stable financial future while enjoying the peace of mind that comes from investing in tangible assets.

![PUBG: Battlegrounds — обновление 37.1 [новинки и баги]](https://camlive.ovh/upload/photos/2025/08/uOctoq8npwvqQCJz152i_18_2c2257b972098cce13abe2f921249625_image.png)