Market Overview:

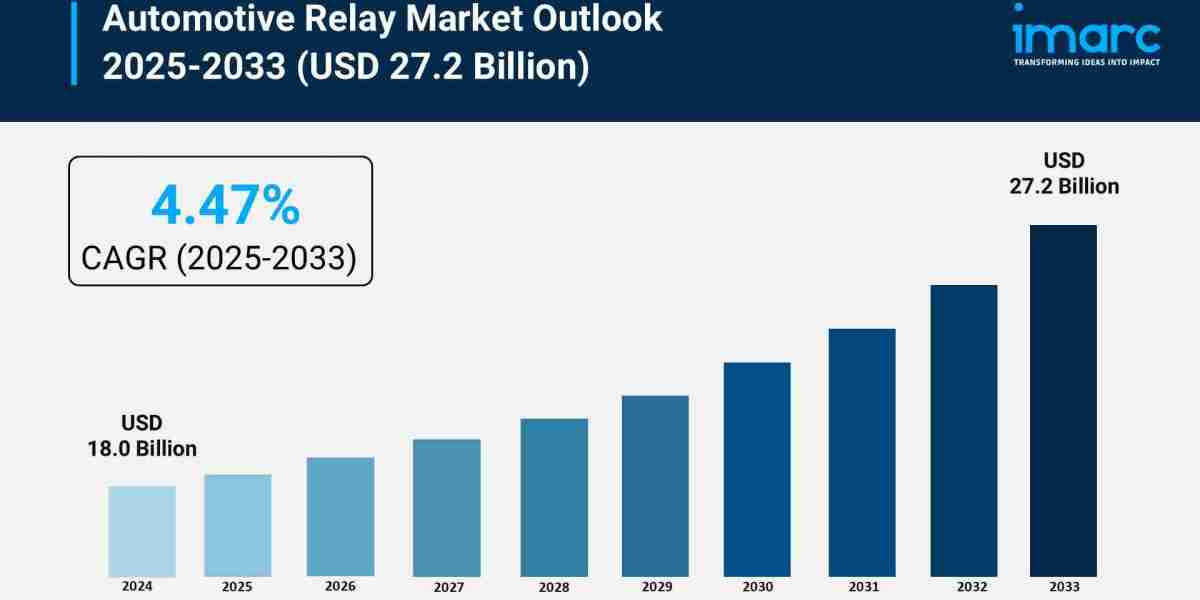

The automotive relay market is experiencing rapid growth, driven by vehicle electrification and high-voltage systems, advanced driver-assistance systems (ADAS) integration, and growing demand for comfort and convenience electronics. According to IMARC Group's latest research publication, "Automotive Relay Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", the global automotive relay market size reached USD 18.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.47% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/automotive-relay-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Automotive Relay Market

- Vehicle Electrification and High-Voltage Systems

The exponential rise in the production and adoption of Electric Vehicles (EVs) and Hybrid Electric Vehicles (HEVs) is a primary catalyst for market expansion. These vehicles require a substantially higher number of high-performance relays compared to traditional internal combustion engine (ICE) cars. For example, industry specialists estimate that while a budget ICE passenger vehicle uses around 30 to 40 relays, an EV typically requires an average of 60 to 70 relays to manage its complex electrical architecture. The relays are critical for handling the high currents and high voltages in applications like the battery management system (BMS), DC charging interfaces, main contactors, and power distribution units. This essential role in coordinating the battery, motor, and charging components ensures safety and efficiency, directly fueling demand for specialized, high-voltage relay products from companies like Panasonic and TE Connectivity.

- Advanced Driver-Assistance Systems (ADAS) Integration

The continuous integration of sophisticated Advanced Driver-Assistance Systems (ADAS) into vehicles across all segments is a major growth factor. ADAS features, which enhance safety and driving convenience, rely heavily on a complex network of electronic control units, sensors, and actuators, all requiring precise switching and control provided by relays. For instance, systems such as adaptive cruise control, lane departure warning, and emergency brake assistance are often mandated by regulatory bodies like the European Union's General Safety Regulation (GSR) and the US Federal Motor Vehicle Safety Standards (FMVSS). The necessity to reliably manage power to these advanced components, including radar, lidar, cameras, and associated motor controls, is increasing the overall electronic load and, consequently, the number of relays per vehicle in safety and security applications.

- Growing Demand for Comfort and Convenience Electronics

Consumer demand for enhanced comfort, luxury, and connectivity features is driving the incorporation of advanced electronic systems in modern automobiles, directly benefiting the relay market. Modern vehicles, including mid-sized cars, are increasingly equipped with features like multi-zone climate control, power windows and seats, sophisticated infotainment units, and keyless entry systems. These auxiliary electronic components require relays for reliable power switching. Automotive manufacturers are responding to market preferences by integrating more sophisticated body control modules and driver information systems. This trend of "automotive digitalization," coupled with rising urbanization and disposable income in markets like the Asia-Pacific region, ensures sustained demand for relays in body and comfort systems, contributing significantly to the overall market growth.

Key Trends in the Automotive Relay Market

- The Rise of Solid-State Relays (SSRs)

A significant emerging trend is the accelerated shift from conventional electromechanical relays (EMRs) to Solid-State Relays (SSRs), particularly in high-performance and high-reliability applications. SSRs utilize semiconductor components, such as transistors, instead of mechanical contacts for switching. This substitution offers distinct advantages, including faster response times, increased durability, and a longer operational lifespan due to the absence of moving parts that wear out. Concrete examples of this trend include companies like Texas Instruments (TXN) releasing isolated solid-state relays designed specifically for use in high-voltage 800-V battery management systems in electric vehicles. The trend toward SSRs is driven by the need for enhanced safety and stability in the sensitive electronic systems of modern and autonomous vehicles.

- Miniaturization and High-Power PCB Relays

The push for increased fuel efficiency and space optimization in modern vehicle design is driving a strong trend toward miniaturization, especially in Printed Circuit Board (PCB) relays. Manufacturers are developing ultra-compact PCB relays that can still handle high current loads, allowing for smaller, lighter Electronic Control Units (ECUs) and wiring harnesses. For example, some companies have launched ultra-compact, 50A PCB relays that feature a high current-carrying capacity for use in medium-to-heavy loads like electric power steering and radiator fans. This focus on compact structure and high switching capacity is a direct response to the increasing density of electronics within vehicles. The successful development of these high-performance, space-efficient relays is vital for widespread adoption in smaller, high-volume passenger vehicles.

- Integration of Smart and Diagnostic Relays

The automotive industry's trend toward connected and smart vehicles is fostering the development of smart relays with integrated diagnostic capabilities. These next-generation relays are designed to communicate real-time operational data, health status, and potentially even support remote diagnostics through vehicle communication networks. This functionality is crucial for predictive maintenance, improving overall vehicle reliability, and simplifying the troubleshooting of complex electrical faults. Real-world applications of this trend include the use of such relays in interconnected infotainment, telematics, and advanced safety modules. The ability of these components to be part of an intelligent, networked system aligns with the industry's progression toward higher levels of vehicle automation and connectivity, optimizing electrical power management across the vehicle.

Leading Companies Operating in the Global Automotive Relay Industry:

- ABB Ltd.

- BorgWarner Inc.

- DENSO Corporation

- Eaton Corporation plc

- Fujitsu Limited (Furukawa Co. Ltd.)

- HELLA GmbH & Co. KGaA

- Littelfuse Inc.

- LS Automotive India Pvt Ltd.

- OMRON Corporation

- Panasonic Corporation

- Robert Bosch GmbH

- Siemens AG

- TE Connectivity

Automotive Relay Market Report Segmentation:

By Product:

- PCB Relay

- Plug-in Relay

- High Voltage Relay

- Others

PCB relay accounts for the majority of shares due to its compact design, low electromagnetic interference, and suitability for dense electronic architectures in modern vehicles.

By Application:

- Powertrain Systems

- Body and Chassis

- Convenience

- Safety and Security

- Driver Information

Convenience dominates the market as modern vehicles increasingly integrate power windows, seats, sunroofs, and climate control systems requiring reliable relay switching.

By Vehicle Type:

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles

Passenger vehicles hold the leading position driven by global consumer demand, increasing electronic features, and the shift toward electric and hybrid powertrains requiring sophisticated relay systems.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to large-scale vehicle manufacturing, particularly in China and India, combined with rapid EV adoption and supportive government policies promoting automotive industry growth.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302