Saudi Arabia Toys and Games Market Overview

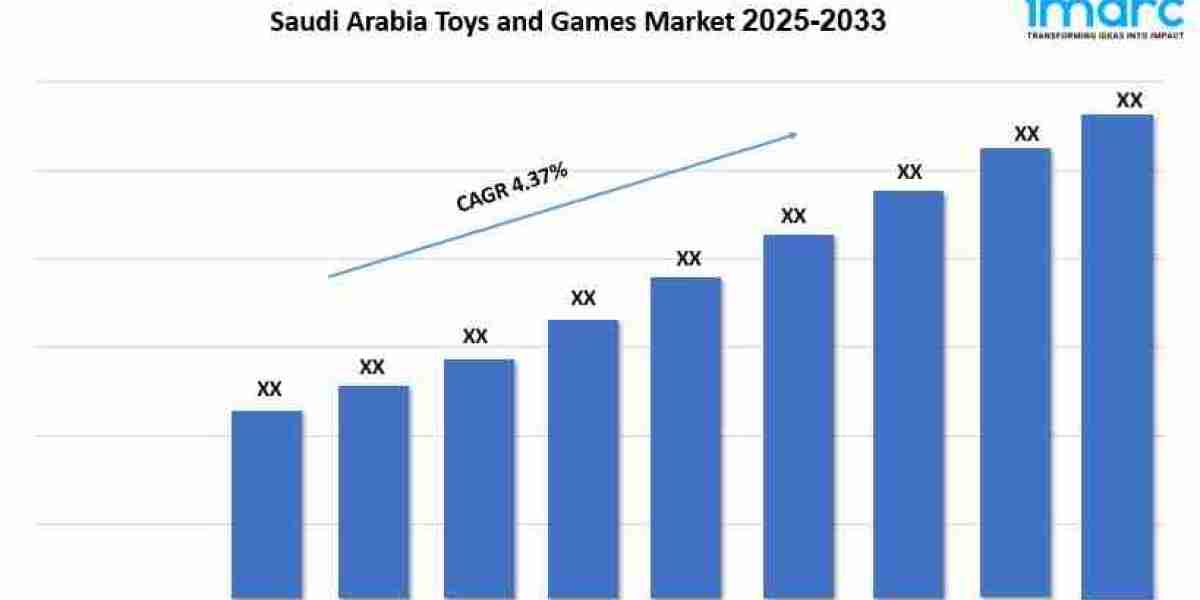

Market Size in 2024: USD 1,101.7 Million

Market Size in 2033: USD 1,618.9 Million

Market Growth Rate 2025-2033: 4.37%

According to IMARC Group's latest research publication, "Saudi Arabia Toys and Games Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia toys and games market size reached USD 1,101.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,618.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.37% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Toys and Games Market

- AI-powered interactive toys enhance learning experiences through personalized content adaptation, responding to children's skill levels and preferences to create customized educational pathways in Saudi homes.

- Machine learning algorithms analyze play patterns and developmental milestones, enabling smart toys to recommend age-appropriate activities and track cognitive progress for parents across the Kingdom.

- AI-driven augmented reality (AR) integration transforms traditional toys into immersive educational experiences, bringing characters to life and creating interactive storytelling environments that captivate Saudi children.

- Natural language processing enables conversational toys and games to communicate in both Arabic and English, supporting bilingual education and cultural identity preservation while engaging children in meaningful dialogue.

- Predictive analytics help Saudi retailers optimize inventory management and product recommendations, analyzing purchasing trends to stock the right toys for different seasons, festivals, and cultural celebrations throughout the year.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-toys-games-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Toys and Games Industry

Saudi Arabia's Vision 2030 is fundamentally transforming the toys and games market by prioritizing family entertainment, child development, and diversification of the leisure sector. With nearly 30% of the population under 15 years old, the government's focus on creating a vibrant society with enriching entertainment options directly impacts toy industry growth. Vision 2030's Quality of Life Program promotes family-friendly activities and recreational facilities, driving demand for both educational and entertainment toys across the Kingdom. The initiative encourages the development of theme parks, entertainment centers, and family destinations, creating new touchpoints for toy brands and licensed merchandise.

Saudi Arabia Toys and Games Market Trends & Drivers:

The Saudi Arabia toys and games market is experiencing robust growth, driven by rising disposable incomes and a large young population that naturally fuels demand for diverse play products. Parents are increasingly focused on supporting their children's development through play, opting for educational toys that activate creativity, problem-solving potential, and social connections. Higher disposable incomes have shifted consumer behavior toward purchasing premium and branded toys, with international brands associated with entertainment franchises, characters, and advanced technology gaining significant popularity. Saudi families are willing to invest in higher-quality products that are durable, innovative, and offer unique experiences, driving demand for collectibles, electronic toys, and themed merchandise.

The rapid expansion of e-commerce platforms has transformed how toys and games are marketed and sold throughout the Kingdom. Online retailers such as Amazon.com, Noon.com, Salla.sa, and AliExpress offer convenience, wide product selection, and access to international brands, especially benefiting families in non-urban areas. These platforms allow customers to compare products and prices while offering discounts, rewards, and cashback under customer retention programs. Digital marketing through social media platforms and influencers plays a key role in shaping trends, especially among younger parents, making toy shopping more dynamic, personalized, and responsive to consumer preferences. In June 2024, SoftBank-backed online retailing unicorn FirstCry announced plans to enhance its presence in the Middle East, opening 12 new modern stores in Saudi Arabia with warehouses in Riyadh, Jeddah, and Dammam to capture growing e-commerce demand.

Saudi Arabia Toys and Games Industry Segmentation:

The report has segmented the market into the following categories:

Product Type Insights:

- Plush Toys

- Infant/Preschool Toys

- Activity Toys

- Dolls

- Games and Puzzles

- Ride-Ons

- Others

Distribution Channel Insights:

- Specialty Stores

- Supermarkets and Hypermarkets

- Departmental Stores

- Online Stores

- General Stores

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players. The market features a moderately competitive landscape with international toy giants operating alongside regional retailers and specialty stores. Companies are focusing on expanding omnichannel presence, forming entertainment partnerships, and introducing culturally relevant products to enhance their market position and capture growing demand across diverse consumer segments.

Recent News and Developments in Saudi Arabia Toys and Games Market

- October 2024: Mattel announced two strategic alliances with Formula 1 (F1) and Saudi Entertainment Ventures (SEVEN) to introduce Hot Wheels e-karting racing tracks into six Saudi cities. This partnership transforms Hot Wheels from a toy line into a completely immersive entertainment experience, introducing new toys, experiences, and go-kart courses to family entertainment venues throughout Saudi Arabia.

- September 2024: Kids and Toys Expo, one of the biggest platforms for toy companies in the Middle East, was announced to take place from September 16-18, 2025, at the Riyadh Front Exhibition & Conference Center, showcasing kids' mobility, toys and games, and education and learning products.

- January 2025: Woodbee Toys, a major company in manufacturing sustainable wooden toys, announced expansion plans into Saudi Arabia and Sri Lanka markets, focusing on eco-friendly and educational toy products aligned with growing environmental consciousness among Saudi consumers.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201-971-6302