Saudi Arabia Baby Apparel Market Overview

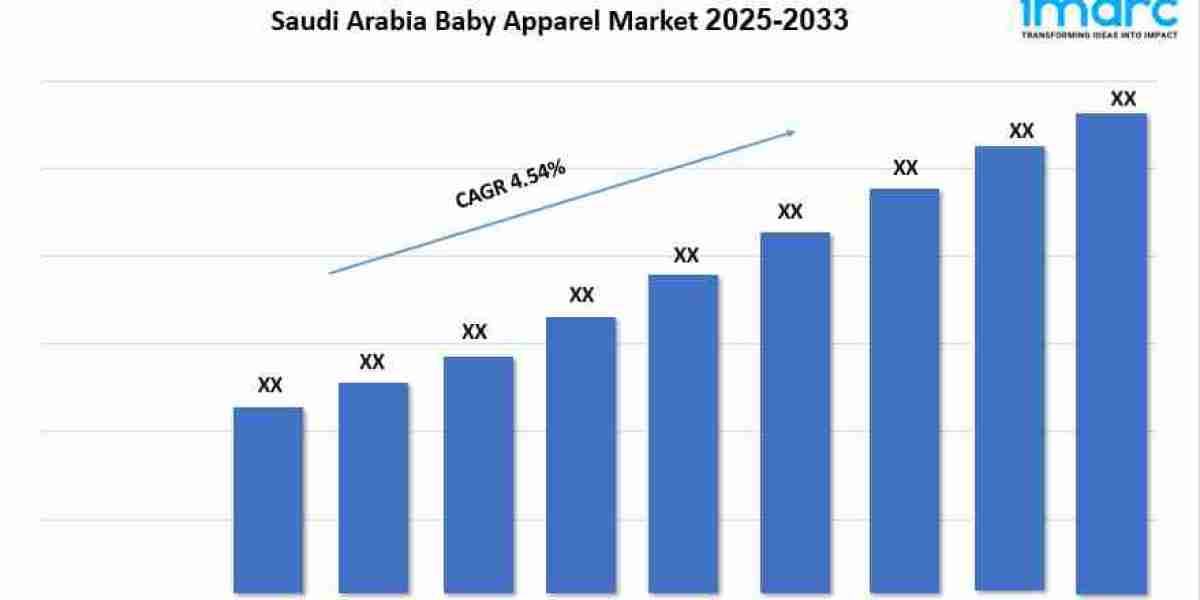

Market Size in 2024: USD 2,106.8 Million

Market Size in 2033: USD 3,117.4 Million

Market Growth Rate 2025-2033: 4.45%

According to IMARC Group's latest research publication, "Saudi Arabia Baby Apparel Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia baby apparel market size was valued at USD 2,106.8 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 3,117.4 Million by 2033, exhibiting a CAGR of 4.45% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Baby Apparel Market

- AI-powered demand forecasting analyzes historical sales patterns, social media trends, and regional preferences in Saudi Arabia, enabling baby apparel retailers to predict seasonal demand accurately and optimize inventory levels across distribution channels.

- Machine learning algorithms personalize shopping experiences by analyzing parent browsing behavior, purchase history, and baby age milestones, recommending appropriate clothing sizes, styles, and seasonal items that match individual family needs and preferences.

- Deep learning models optimize supply chain efficiency by predicting lead times, identifying potential disruptions, and automating reorder points for baby apparel retailers, reducing stockouts during peak seasons and minimizing excess inventory carrying costs.

- AI-driven visual search technology enables Saudi parents to upload baby clothing images and instantly discover similar products across online stores, streamlining product discovery and enhancing conversion rates for e-commerce platforms.

- Intelligent pricing algorithms analyze competitor pricing, demand elasticity, and seasonal trends in real-time, automatically adjusting baby apparel pricing strategies to maximize sales velocity while maintaining healthy profit margins throughout product lifecycles.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-baby-apparel-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Baby Apparel Industry

Saudi Arabia's Vision 2030 is revolutionizing the baby apparel industry by prioritizing retail sector modernization, e-commerce expansion, and women's economic participation amid demographic transformation. The initiative drives demand for fashionable, quality baby clothing, integrating digital retail channels to enhance consumer accessibility across the Kingdom's youthful population. This transformation aligns with economic diversification goals, promoting local manufacturing capabilities and reducing import dependence through the National Industrial Development and Logistics Program. Government investments in digital infrastructure enable e-commerce platforms serving tech-savvy Saudi parents, with the Ministry of Commerce reporting e-commerce businesses reaching 40,953 registered entities in Q4 2024, creating convenient access to diverse baby apparel offerings. The Saudi General Authority for Statistics data showing 71% of citizens below age 35 with median age 23.5 demonstrates a young demographic driving continuous demand for baby products as families form and expand. Strategic initiatives including women's workforce participation reaching historic levels under Vision 2030 create dual-income households with higher purchasing power for premium baby apparel, while social reforms enabling greater female mobility expand shopping behaviors and retail engagement.

Saudi Arabia Baby Apparel Market Trends & Drivers:

Saudi Arabia's baby apparel market is experiencing robust growth, driven by influence of Western and global fashion trends as growing exposure to international styles through travel, social media, and international retailers influences Saudi parents' preferences when dressing their children. Western fashion trends particularly have introduced demand for stylish, seasonal, and branded baby clothing, with this globalization of taste encouraging local retailers and international brands to expand baby apparel lines throughout the Kingdom. Parents increasingly view children's clothing as expression of identity and status, driving interest in designer and trendy outfits. In June 2024, FirstCry, an e-commerce unicorn backed by SoftBank, announced intentions to grow its Middle East presence by implementing its India strategy internationally, with the nation's largest multichannel retailer of baby products aiming to launch 12 new contemporary stores in Saudi Arabia and additional warehouses in Riyadh, Jeddah, and Dammam. In January 2025, worldwide clothing retailer Giordano Saudi Arabia launched its "Giordano x Kung Fu Panda" collaboration line commemorating New Year 2025, seeking to strengthen worldwide brand presence while honoring cultural moments connecting with varied audiences, with limited-edition products available in stores and online across major markets including Saudi Arabia and the UAE.

The expanding e-commerce and retail channels are significantly boosting market demand. The rise of e-commerce platforms in Saudi Arabia has contributed substantially to baby apparel market growth, with parents enjoying easy access to wide varieties of brands and styles without visiting physical stores. Online marketplaces offer convenience, product variety, competitive pricing, and quick delivery crucial for young families. Retail chains and international baby brands are increasingly establishing strong online presence to reach tech-savvy Saudi consumers, with the Ministry of Commerce reporting e-commerce businesses reaching 40,953 registered entities in Q4 2024. The digital shift is supported by government investment in digital infrastructure and consumer trust in online shopping, accelerating reach and penetration of baby apparel offerings. Sustainable apparel for children is gaining traction in Saudi Arabia as consumers become more conscious of environmental and ethical impact of fashion choices, with parents increasingly open to buying good quality clothing made from organic, recycled, or biodegradable materials, prioritizing quality and durability. The increasing disposable incomes and lifestyle changes support market expansion, with rising disposable income levels across Saudi Arabia particularly among young families shifting consumer behavior toward premium, branded, and fashionable baby clothing. Parents are increasingly willing to spend more on high-quality materials, safer fabrics, and stylish designs reflecting broader lifestyle aspirations, with this trend particularly strong in urban areas where families seek modern, comfortable, and aesthetically pleasing apparel for their children.

Saudi Arabia Baby Apparel Industry Segmentation:

The report has segmented the market into the following categories:

Product Insights:

- Outerwear

- Underwear

- Others

Material Insights:

- Cotton

- Wool

- Silk

Distribution Channel Insights:

- Online

- Offline

Application Insights:

- 0-12 Months

- 12-24 Months

- 2-3 Years

End User Insights:

- Girls

- Boys

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Baby Apparel Market

January 2025: Giordano Saudi Arabia launched its "Giordano x Kung Fu Panda" collaboration line commemorating New Year 2025, strengthening worldwide brand presence and honoring cultural moments connecting with varied audiences, with limited-edition products available in stores and online across major markets.

June 2024: FirstCry, an e-commerce unicorn backed by SoftBank, announced intentions to grow Middle East presence by implementing its India strategy internationally, aiming to launch 12 new contemporary stores in Saudi Arabia and additional warehouses in Riyadh, Jeddah, and Dammam.

Q4 2024: The Ministry of Commerce reported Saudi Arabia's e-commerce sector sustained strong expansion with registered businesses reaching over forty thousand entities, facilitating baby apparel accessibility through digital channels and enabling convenient online shopping for tech-savvy Saudi parents.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302