In today's financial landscape, individuals with bad credit often face significant challenges when seeking personal loans. Traditional lenders typically require extensive documentation, including proof of income, credit history, and employment verification, which can be particularly difficult for those with poor credit ratings. However, no doc bad credit personal loans have emerged as a viable alternative for borrowers in need of quick access to funds without the burden of extensive paperwork. If you enjoyed this short article and you would certainly such as to get even more info concerning small personal loans for bad credit near me (Goapropertysyndicate explains) kindly visit our own website. This case study will explore the concept of no doc bad credit personal loans, their advantages and disadvantages, and a real-life scenario illustrating their impact on a borrower's financial situation.

Understanding No Doc Bad Credit Personal Loans

No doc bad credit personal loans are designed for individuals who have a low credit score and may not have the necessary documentation to qualify for traditional loans. These loans typically require minimal paperwork, making them accessible to a broader range of borrowers. Lenders offering these loans often rely on alternative data points, such as bank statements, employment history, and other non-traditional metrics, to assess a borrower's creditworthiness.

Advantages of No Doc Bad Credit Personal Loans

- Accessibility: The primary advantage of no doc loans is their accessibility. Borrowers with bad credit or those who are self-employed may find it challenging to provide the documentation required by traditional lenders. No doc loans eliminate this barrier, allowing more individuals to secure financing.

- Quick Approval: The streamlined application process for no doc loans often results in quicker approval times. Borrowers can receive funds within a matter of days, making these loans an attractive option for those facing urgent financial needs.

- Flexibility: No doc loans can be used for a variety of purposes, including debt consolidation, home repairs, medical expenses, or unexpected emergencies. This flexibility allows borrowers to address their immediate financial challenges without restrictions.

- Building Credit: For borrowers with bad credit, successfully repaying a no doc loan can help improve their credit score over time. This can open doors to better financing options in the future.

Disadvantages of No Doc Bad Credit Personal Loans

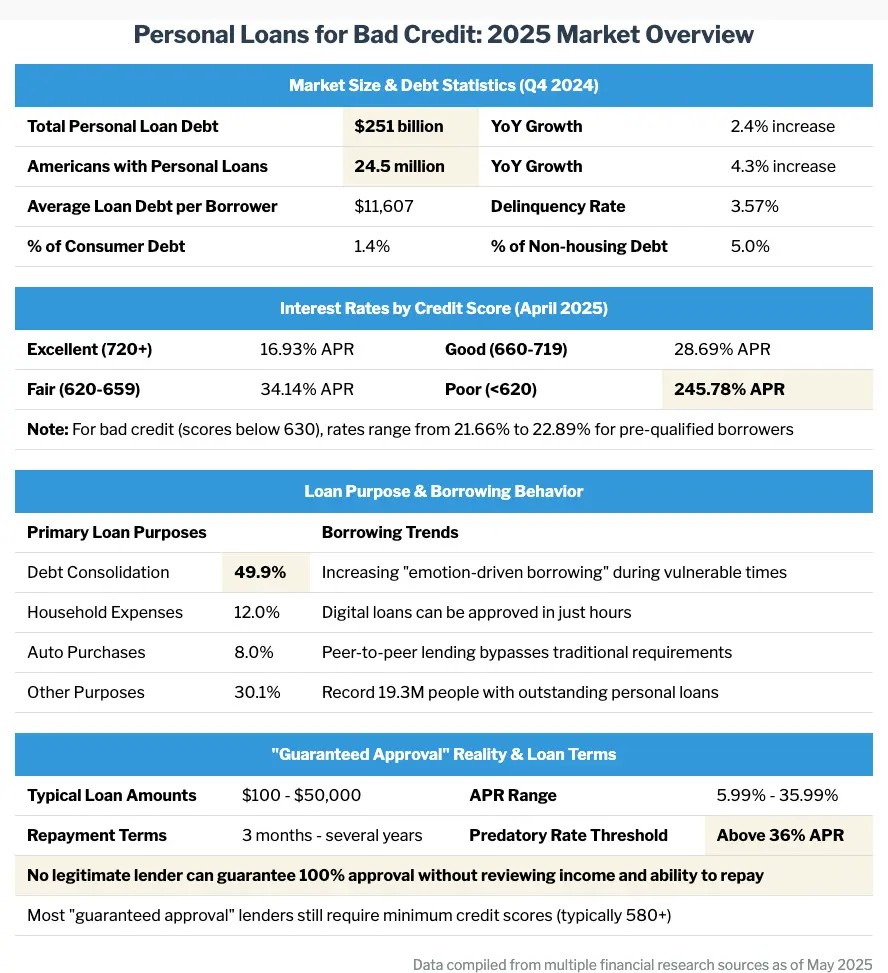

- Higher Interest Rates: One of the most significant drawbacks of no doc loans is the higher interest rates associated with them. Lenders take on more risk when providing loans to individuals with bad credit, and this risk is often reflected in the cost of borrowing.

- Shorter Loan Terms: No doc loans typically come with shorter repayment terms, which can lead to higher monthly payments. Borrowers may find it challenging to manage these payments, especially if they are already facing financial difficulties.

- Potential for Predatory Lending: The lack of regulation in the no doc loan market can lead to predatory lending practices. Borrowers must be cautious and conduct thorough research to avoid falling victim to unscrupulous lenders.

- Limited Loan Amounts: No doc loans may come with lower borrowing limits compared to traditional loans. This can be a disadvantage for borrowers seeking larger amounts to cover significant expenses.

Case Study: Sarah's Experience with No Doc Bad Credit Personal Loans

To illustrate the impact of no doc bad credit personal loans, let’s consider the case of Sarah, a 32-year-old single mother living in a suburban area. Sarah had a credit score of 580 due to a history of late payments and high credit card balances. After losing her job during the pandemic, Sarah struggled to find stable employment and fell behind on her bills. With mounting medical expenses for her child and the need for urgent home repairs, Sarah found herself in a financial crisis.

Desperate for a solution, Sarah began exploring her options for personal loans for bad credit long term loans. After being denied by several traditional lenders due to her credit history, she stumbled upon a lender specializing in no doc bad credit personal loans. The application process was straightforward; she only needed to provide a few bank statements and proof of her current employment at a part-time job.

Within 48 hours, Sarah received approval for a $5,000 loan with a repayment term of 18 months and an interest rate of 25%. While the interest rate was higher than she had hoped for, Sarah felt relieved to have access to the funds she desperately needed. She used the loan to pay for her child’s medical bills and to make critical repairs to her home, including fixing a leaky roof.

Initially, the higher monthly payments were a challenge for Sarah, but she managed her budget carefully and prioritized her loan repayment. Over the next year and a half, Sarah made consistent payments, and by the time she completed the loan, her credit score had improved to 620. This positive change opened the door for Sarah to qualify for a traditional loan to consolidate her debt and further improve her financial situation.

Conclusion

No doc bad credit personal loans can provide a lifeline for individuals facing financial difficulties, particularly those with poor credit histories. While these loans offer quick access to funds with minimal documentation, borrowers must be aware of the associated risks, including higher interest rates and potential predatory lending practices. As illustrated by Sarah's case, these loans can serve as a stepping stone towards financial recovery, enabling borrowers to address immediate needs while working towards improving their creditworthiness. Ultimately, individuals considering no doc bad credit personal loans should conduct thorough research and assess their ability to manage the loan responsibly to ensure a positive outcome in their financial journey.