Market Overview:

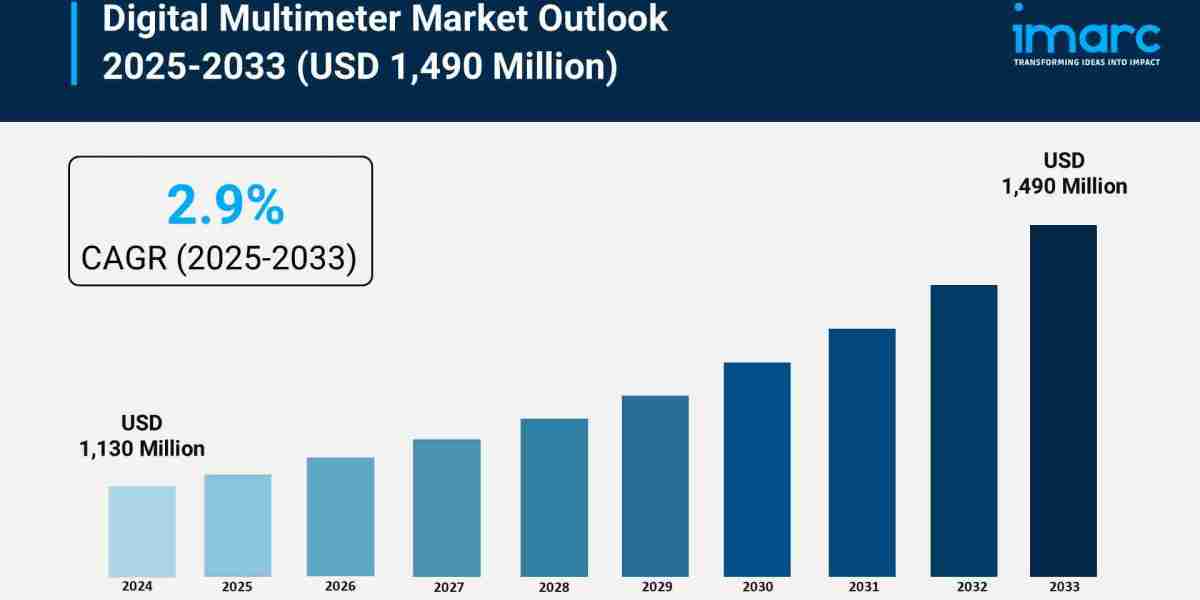

The digital multimeter market is experiencing rapid growth, driven by surge in electric vehicle (ev) adoption and automotive electronics, industrial automation and the rise of industry 4.0, and global transition to renewable energy and smart grids. According to IMARC Group’s latest research publication, “Digital Multimeter Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033”, the global digital multimeter market size reached USD 1,130 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,490 Million by 2033, exhibiting a growth rate (CAGR) of 2.9% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/digital-multimeter-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Digital Multimeter Market

- Surge in Electric Vehicle (EV) Adoption and Automotive Electronics

The rapid expansion of the electric vehicle market serves as a primary catalyst for the digital multimeter industry. Unlike traditional internal combustion engines, EVs rely on high-voltage battery systems, sophisticated power electronics, and intricate sensor networks that require high-precision testing during both manufacturing and maintenance. Currently, the automotive segment accounts for approximately 30.05% of the total revenue in the global multimeter market. Major manufacturers like Fluke and Keysight are developing specialized DMMs capable of handling DC voltages exceeding 1000V to accommodate the heavy-duty requirements of EV battery packs. Government initiatives, such as the U.S. Federal EV Tax Credit and the European Green Deal, have accelerated the production of these vehicles, subsequently increasing the demand for diagnostic tools that ensure battery health and circuit integrity. This transition has led to a reported 34% increase in the procurement of high-accuracy multimeters by automotive service centers and public utility providers globally.

- Industrial Automation and the Rise of Industry 4.0

Industrialization and the adoption of Industry 4.0 principles are significantly driving the demand for digital multimeters in manufacturing environments. As factories transition to automated assembly lines, there is an indispensable need for real-time voltage and resistance monitoring to maintain quality control and prevent costly downtime. Current data indicates that over 45 million circuit boards are manufactured monthly worldwide, with approximately 68% of these production operations integrating digital multimeters directly into their testing protocols. The handheld segment remains dominant, holding a 62% market share due to its portability and ease of use for technicians performing on-site diagnostics. Furthermore, the increasing use of predictive maintenance strategies has prompted companies to invest in advanced DMMs that can detect harmonics and thermal anomalies in motor controls. Leading firms like Bosch have recently introduced ruggedized multimeters specifically designed for construction and industrial sites, featuring impact-resistant sheathing to withstand harsh operational conditions.

- Global Transition to Renewable Energy and Smart Grids

The global shift toward renewable energy sources, such as solar and wind, has created a robust market for digital multimeters in energy management. Renewable installations require precise measurement of DC-to-AC conversion efficiency and inverter performance to ensure grid stability. For instance, India’s target of reaching 500 GW of non-fossil capacity by 2030 has spurred a massive demand for testing equipment across solar farms and battery storage facilities. Digital multimeters with IP67-rated enclosures, which provide protection against dust and water, have seen their demand triple in recent years due to their use in outdoor energy infrastructure projects. Government-led smart grid initiatives, with over 8,000 projects initiated globally in the last two years, rely on these devices for routine inspection and troubleshooting. This trend is further supported by the "Make in India" initiative and similar domestic manufacturing policies that encourage the local production and adoption of high-performance electrical diagnostic tools.

Key Trends in the Digital Multimeter Market

- Integration of IoT and Wireless Connectivity

A defining trend in the digital multimeter market is the integration of Internet of Things (IoT) capabilities, allowing devices to transmit data wirelessly via Bluetooth or Wi-Fi. This innovation enables technicians to monitor measurements remotely from a safe distance, which is particularly critical when dealing with high-voltage circuits or hazardous environments. Modern smart multimeters can sync with mobile applications to log data in real-time, generate automated reports, and perform trend analysis over extended periods. Companies like Hioki have launched models that support wireless communication, allowing measured data to be entered directly into cloud-based templates for immediate review by engineering teams. This shift toward connected ecosystems reduces human error and facilitates collaboration, as multiple stakeholders can access the same diagnostic data simultaneously through secure digital platforms, marking a move away from standalone, isolated hardware.

- Adoption of AI-Driven Predictive Maintenance

The emergence of Artificial Intelligence (AI) within the testing and measurement sector is revolutionizing how digital multimeters are utilized for asset management. AI-capable multimeters are now being developed to reference historical measurement data and provide predictive suggestions about potential circuit failures before they occur. These devices use sophisticated digital signal processing algorithms to filter out environmental noise and temperature variations, ensuring higher accuracy in sensitive diagnostic tasks. In industrial settings, this technology is applied to identify "hotspots" or irregular power consumption patterns in machinery, allowing for proactive repairs. Real-world applications include the use of AI-enhanced DMMs in medical device manufacturing, where even minor fluctuations in electrical performance can have critical consequences. By shifting from reactive troubleshooting to predictive intelligence, these advanced tools help organizations significantly reduce machine downtime and extend the lifecycle of expensive electrical infrastructure.

- Development of Hybrid Multi-Function Diagnostic Tools

Manufacturers are increasingly moving toward the creation of hybrid devices that combine the traditional functions of a digital multimeter with other specialized measurement technologies. A prominent example is the integration of thermal imaging sensors into standard DMM units, enabling users to visually identify heat-related issues while simultaneously taking electrical readings. This dual-functionality is becoming a standard in HVAC and building maintenance, where identifying a loose connection often requires both a visual thermal check and a voltage test. Furthermore, new "pocket-sized" wireless cell testers have been introduced to the market, offering high-precision lithium battery monitoring with 1% accuracy levels. These compact, multi-functional tools cater to the growing "DIY" culture and the needs of field technicians who require versatile equipment that minimizes the number of separate tools they must carry, ultimately streamlining the diagnostic process across various technical disciplines.

Leading Companies Operating in the Global Digital Multimeter Industry:

- Agilent Technologies

- Anritsu

- Danaher

- Rohde & Schwarz

- Tektronix

- Adlink Technology

- Aeroflex

- Ametek

- Giga-tronics

- National Instruments

- Rigol Technologies

- Teledyne LeCroy

- Teradyne

- Yokogawa Electric

Digital Multimeter Market Report Segmentation:

By Product Type:

- Handheld

- Bench-Top

- Mounted

- Others

Handheld digital multimeters account for the majority of shares due to their portability, ease of use, and suitability for field applications across various industries.

By Functionality:

- Analog Multimeter

- Digital Multimeter

- Fluke Multimeter

- Others

Digital multimeters dominate the market due to their superior accuracy, digital display readability, and advanced features like data logging and connectivity.

By End Use Industry:

- Automotive

- Manufacturing

- Energy

- Utility

- Others

Manufacturing represents the leading market segment owing to extensive use in quality control, equipment maintenance, and production line troubleshooting across diverse manufacturing facilities.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Asia Pacific enjoys the leading position owing to rapid industrialization, expanding electronics manufacturing sector, and increasing investment in electrical infrastructure development across emerging economies.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302