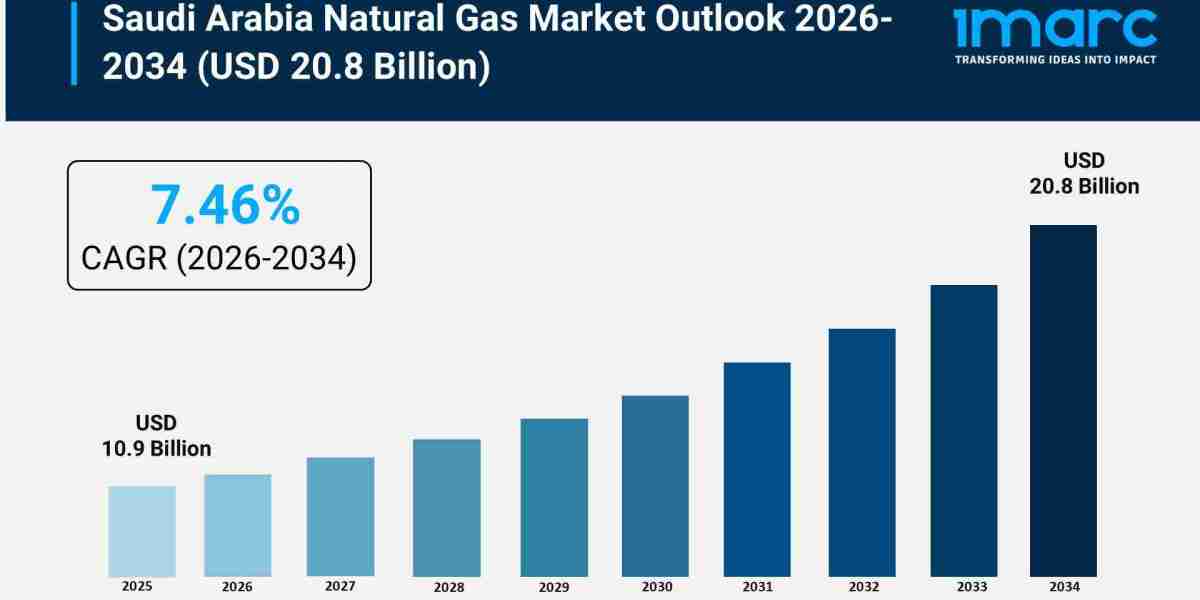

Saudi Arabia Natural Gas Market Overview

Market Size in 2025: USD 10.9 Billion

Market Size in 2034: USD 20.8 Billion

Market Growth Rate 2026-2034: 7.46%

According to IMARC Group's latest research publication, "Saudi Arabia Natural Gas Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia natural gas market size was valued at USD 10.9 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 20.8 Billion by 2034, exhibiting a CAGR of 7.46% during 2026-2034.

How AI is Reshaping the Future of Saudi Arabia Natural Gas Market

- AI-powered predictive maintenance systems monitor pipeline networks and processing facilities across Saudi Arabia, detecting leaks and equipment failures before they occur, reducing operational downtime and enhancing safety significantly.

- Smart sensors integrated with AI algorithms optimize gas compression and flow management in the Master Gas System, improving energy efficiency and reducing operational costs throughout the Kingdom's extensive pipeline infrastructure.

- AI-driven demand forecasting analyzes consumption patterns across industrial, residential, and power generation sectors, enabling Saudi Aramco to optimize production scheduling and distribution planning for natural gas supply.

- Machine learning models enhance unconventional gas extraction at Jafurah field, analyzing geological data to identify optimal drilling locations and improve recovery rates from tight shale formations.

- AI-enabled digital twins simulate entire gas processing facilities, allowing operators to test scenarios and optimize plant configurations before implementation, supporting Saudi Arabia's ambitious gas expansion targets under Vision 2030.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-natural-gas-market/requestsample

How Vision 2030 is Transforming Saudi Arabia Natural Gas Industry

Saudi Arabia's Vision 2030 is revolutionizing the natural gas industry by prioritizing energy diversification, cleaner power generation, and economic transformation amid ambitious infrastructure development. The initiative drives demand for advanced gas infrastructure, integrating cutting-edge technologies to reduce oil dependency and enhance sustainability goals. This transformation aligns with renewable energy integration, promoting natural gas as a bridge fuel and feedstock for hydrogen production in megaprojects like NEOM, Qiddiya, and industrial clusters. Massive investments in gas processing facilities, pipeline networks, and unconventional field development like Jafurah spur domestic production capacity and reduce reliance on oil-fired power generation. Local industrial expansion incentives position natural gas as a critical feedstock for petrochemicals and fertilizers, while power sector conversion from oil to gas frees up crude for export markets. Ultimately, Vision 2030 elevates the sector as a cornerstone of sustainable energy transition, enhancing energy security and positioning Saudi Arabia as a leader in clean hydrocarbon utilization and hydrogen economy development.

Saudi Arabia Natural Gas Market Trends & Drivers:

Saudi Arabia's natural gas market is experiencing robust growth, driven by rising energy demand from increasing population and urbanization rates, with population projections showing significant growth and electricity utilization rising across broadening urban bases and expanding industrialization. The market is fueled by natural gas playing a central role in power generation, offering a cleaner and more cost-effective alternative to crude oil, while the government continues expanding housing projects, commercial zones, and industrial clusters, strengthening reliance on natural gas for sustainable and reliable energy. Household consumption, air conditioning, and desalination plants heavily depend on gas supply, with increasing energy demand ensuring long-term stability for the natural gas sector across the Kingdom.

The rapid expansion of power generation capacity and industrial growth is significantly boosting market demand. With massive initiatives including gas-fired power plants, petrochemical facilities, and manufacturing complexes under Vision 2030, Saudi Arabia is investing heavily in modern combined-cycle power plants that use natural gas to deliver higher energy efficiency. Rising demand from households, commercial centers, and industrial zones makes natural gas the backbone of the electricity sector, while the development of new power grids and renewable integration requires reliable base-load generation where natural gas proves highly effective. The shift towards gas-powered plants aligns with Saudi Arabia's strategy of exporting more oil rather than burning it domestically, while industrial expansion particularly in petrochemicals, fertilizers, and manufacturing significantly catalyzes natural gas demand as both fuel and critical feedstock for production, supporting large-scale industrial output and exports across power generation, industrial, and residential sectors.

Saudi Arabia Natural Gas Market Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

- Compressed Natural Gas

- Piped Natural Gas

- Liquefied Petroleum Gas

Breakup by Region:

- Northern and Central Region

- Western Region

- Eastern Region

- Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Recent News and Developments in Saudi Arabia Natural Gas Market

- January 2025: Saudi Aramco commenced on-site construction activities for the Master Gas System Phase III expansion project across multiple regions including Eastern Province, central and western areas, advancing the strategic gas network development to support rising domestic demand and enable power sector conversion from oil to natural gas aligned with Vision 2030 sustainability objectives.

- February 2025: The third expansion phase of Saudi Aramco's Jafurah gas field development reached advanced contracting stages with major energy technology companies, marking progress in the Kingdom's largest unconventional gas project aimed at substantially increasing non-associated gas production capacity to meet industrial feedstock requirements and power generation needs.

- August 2025: Saudi Aramco signed major midstream infrastructure agreements with international investment consortiums for Jafurah gas processing facilities, demonstrating strong foreign direct investment confidence in Saudi Arabia's natural gas expansion program and supporting the ambitious target to increase gas production capacity significantly by decade's end for petrochemicals, industrial zones, and clean energy applications.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302