A career as a financial advisor requires more than knowledge of investments or financial products. Success depends heavily on a combination of technical expertise, analytical abilities, and interpersonal skills. Developing the right financial advisor skills is crucial for guiding clients effectively and growing a rewarding career.

This article explores the essential skills every financial advisor should possess, how they are applied in practice, and tips for building them.

Core Technical Skills for Financial Advisors

Technical skills form the foundation of any financial advisor’s expertise. They enable accurate analysis, strategic planning, and informed recommendations.

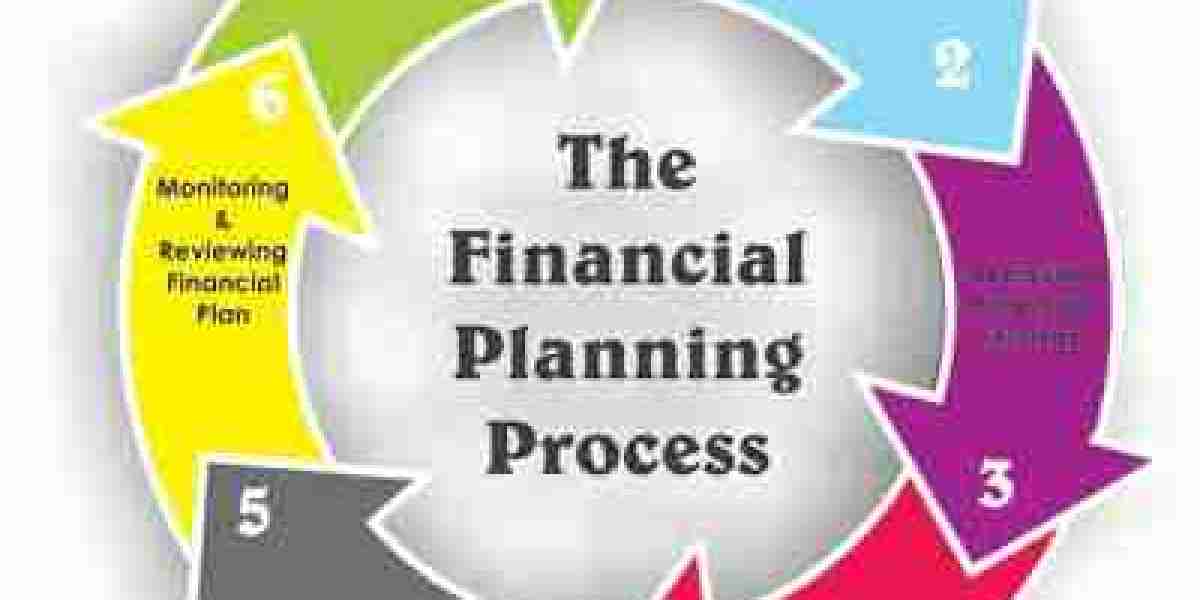

1. Financial Planning and Analysis

A financial advisor must be skilled in evaluating a client’s financial situation. This includes understanding income, expenses, debt, and assets. Advisors use this analysis to create personalized plans that address short-term needs and long-term goals.

2. Investment Knowledge

Understanding investment options, market trends, and portfolio management is essential. Advisors must be able to evaluate stocks, bonds, mutual funds, and alternative investments to develop strategies that align with a client’s risk tolerance and objectives.

3. Risk Assessment and Management

Clients rely on financial advisors to identify potential risks to their wealth. Advisors use risk assessment techniques to mitigate financial exposure, including insurance strategies, diversified investment portfolios, and contingency planning.

4. Retirement and Estate Planning

Advisors need expertise in planning for retirement and managing estates. This includes calculating retirement income needs, choosing suitable retirement accounts, and planning for asset transfer or inheritance.

5. Tax Planning Knowledge

A strong grasp of tax laws and optimization strategies allows advisors to help clients retain more wealth. Effective tax planning can reduce liabilities and improve overall financial efficiency.

Analytical Skills Financial Advisors Must Have

Beyond technical knowledge, analytical skills are crucial for interpreting data and making strategic recommendations.

6. Data Interpretation

Advisors must analyze financial statements, investment reports, and market trends to make informed decisions.

7. Problem-Solving

Clients often face complex financial challenges. Advisors need to develop tailored solutions that address unique needs while considering potential risks and opportunities.

8. Strategic Thinking

Long-term financial success requires foresight. Advisors must anticipate market changes, client needs, and regulatory shifts to provide proactive guidance.

9. Attention to Detail

Accuracy is critical. Even small errors in calculations, projections, or legal compliance can have significant consequences.

Interpersonal and Soft Skills

Technical and analytical skills are important, but soft skills often determine an advisor’s effectiveness and career growth.

10. Communication Skills

Financial advisors must explain complex concepts clearly to clients, ensuring they understand strategies, risks, and recommendations. Clear communication builds trust and credibility.

11. Client Relationship Management

Maintaining long-term client relationships is key. Advisors need empathy, patience, and the ability to understand clients’ priorities and concerns.

12. Negotiation Skills

Advisors may negotiate fees, investment terms, or business arrangements. Strong negotiation ensures mutually beneficial agreements and client satisfaction.

13. Emotional Intelligence

Understanding client emotions and reactions, especially during market fluctuations, allows advisors to provide calm, rational guidance.

14. Ethical Judgment

Trust is the foundation of financial advisory work. Advisors must demonstrate integrity, transparency, and adherence to ethical standards at all times.

Business and Sales Skills

Financial advisors often operate in a competitive environment. Business skills help them grow their client base and manage their practice effectively.

15. Marketing and Client Acquisition

Successful advisors know how to attract new clients through networking, referrals, and targeted marketing strategies.

16. Time Management

Managing multiple clients, meetings, and administrative tasks requires strong organizational skills and prioritization.

17. Technology Proficiency

Advisors must use financial software, analytics tools, and client management systems efficiently. Familiarity with online trading platforms and portfolio management tools is also valuable.

18. Continuous Learning

The financial industry evolves rapidly. Advisors must stay updated on regulations, new financial products, and emerging investment trends.

How to Develop Financial Advisor Skills

Building these skills requires deliberate effort:

Education: Obtain a degree in finance, accounting, economics, or business administration.

Professional Certifications: Consider CFP, CFA, or CPA to enhance credibility and technical knowledge.

Practical Experience: Internships, mentorships, or entry-level advisory roles help develop real-world skills.

Soft Skills Training: Workshops, courses, or coaching in communication, emotional intelligence, and negotiation.

Continuous Learning: Regularly update knowledge on financial markets, tax laws, and regulatory changes.

Developing a balance of technical expertise and interpersonal abilities ensures long-term success.

The Impact of Skills on Career Growth

Financial advisor skills directly influence career progression:

Entry-Level Advisors: Focus on technical knowledge and learning client management.

Mid-Level Advisors: Apply analytical and interpersonal skills to manage larger portfolios and guide more complex financial decisions.

Senior Advisors: Combine strategic thinking, leadership, and business development skills to expand client base and influence firm growth.

Independent Advisors: Rely heavily on a mix of all skills to build and manage a private practice successfully.

Highly skilled advisors often enjoy higher salaries, client trust, and professional recognition.

Conclusion

A successful financial advisor job requires a mix of technical, analytical, interpersonal, and business skills. From financial planning and investment management to communication, ethical judgment, and client relationship building, every skill contributes to professional effectiveness.

Developing and refining these skills allows advisors to provide exceptional guidance, grow their careers, and help clients achieve financial stability and long-term success. For anyone pursuing this career, investing in skill development is just as important as building experience or credentials.